Leasehold definition

/What is a Leasehold?

A leasehold is a designation that is assigned to an asset being leased. Under a lease arrangement, the lessee gains the use of an asset that is owned by the lessor for a certain period of time, in exchange for a series of payments. Leaseholds are common in commercial real estate, where businesses lease office or retail space rather than purchasing it. At the end of the lease term, the rights to the asset revert back to the lessor, unless the lease includes a renewal or purchase option.

Accounting for a Leasehold

The leasehold designation appears in the accounting records of the lessee, and is most commonly seen as a fixed asset account called "Leasehold Improvements". These improvements are capital expenditures applied to a leased asset, such as building space. The lessee amortizes leasehold improvements over the shorter of their useful life or the life of the lease.

Related AccountingTools Course

Presentation of a Leasehold

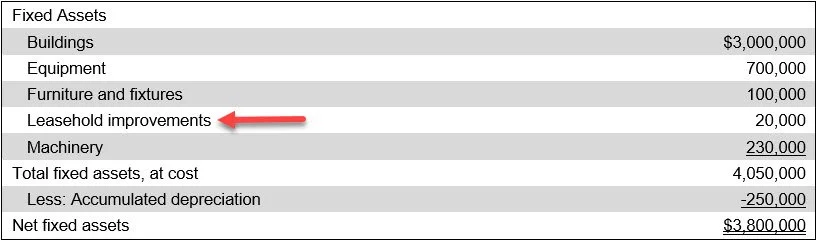

For presentation purposes, a leasehold asset is usually consolidated with the other fixed asset accounts of a business, so that only a single fixed assets line item is presented on its balance sheet. The ending balance in the leasehold asset account is usually considered too immaterial to be worth presenting separately. If it were to be presented, it might appear as noted in the following exhibit.