The purpose of depreciation

/What is Depreciation?

Depreciation is the systematic allocation of the cost of a tangible fixed asset over its useful life. It reflects the gradual reduction in the asset's value due to wear and tear, usage, or obsolescence. Depreciation is recorded as an expense on the income statement, helping to match the cost of the asset with the revenue it generates over time. This accounting process is essential for providing a more accurate picture of a company's profitability and the true value of its assets.

What is the Purpose of Depreciation?

The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. This is called the matching principle, where revenues and expenses both appear in the income statement in the same reporting period, thereby giving the best view of how well a company has performed in a given reporting period.

The trouble with this matching concept is that there is only a tenuous connection between the generation of revenue and a specific asset. Under the tenets of constraint analysis, all of the assets of a company should be treated as a single system that generates a profit; thus, there is no way to link a specific fixed asset to specific revenue.

To get around this linkage problem, we assume a steady rate of depreciation over the useful life of each asset, so that we approximate a linkage between the recognition of revenues and expenses over time. This approximation threatens our credulity even more when a company uses accelerated depreciation, since the main reason for using it is to defer the payment of taxes (and not to better match revenues and expenses). Also, the matching principle does not work in those cases where depreciation expense is recognized but there are no sales, as occurs in seasonal sales situations.

The type of depreciation that most closely links the creation of revenue to asset usage is the depletion method, which charges natural resources to expense as they are extracted. However, this option is not available for most types of fixed assets.

Related AccountingTools Courses

Under no circumstances should we consider depreciation to be an approximation of a decline in an asset's fair value, since fair value can increase or decrease over time and is related to supply and demand, rather than usage.

If we were not to use depreciation at all, then we would be forced to charge all assets to expense as soon as we buy them. This would result in large losses in the months when this transaction occurs, followed by unusually high profitability in those periods when the corresponding amount of revenue is recognized, with no offsetting expense. Thus, a company that does not use depreciation will have front-loaded expenses, and will experience extremely variable financial results.

Accounting for Depreciation

The typical journal entry to record depreciation is a debit to depreciation expense (which appears on the income statement) and a credit to accumulated depreciation (which appears as a contra account in the balance sheet). When a fixed asset is eventually sold or otherwise disposed of, the asset and associated accumulated depreciation are reversed to clear them from the books; a gain or loss may also be recorded.

Presentation of Depreciation

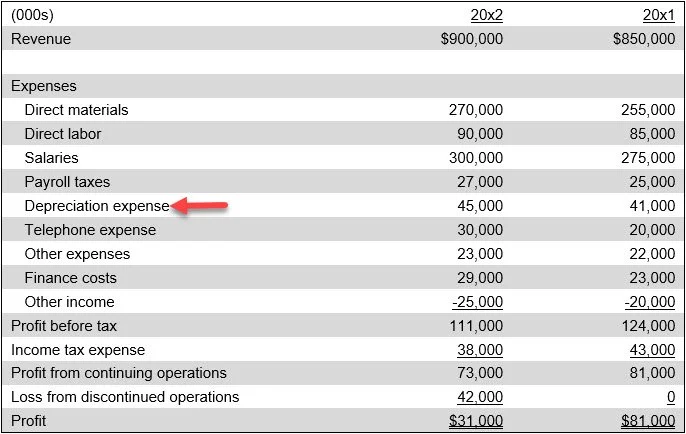

Depreciation expense is presented within the income statement. If related to the production process, it may appear within the cost of goods sold. If unrelated to production, then depreciation expense appears within the selling, general and administrative section of the income statement. Accumulated depreciation is presented as a offset to the fixed assets line item within the balance sheet. A sample of where depreciation appears on the income statement as a separate line item appears in the following exhibit.