Other comprehensive income definition

/What is Other Comprehensive Income?

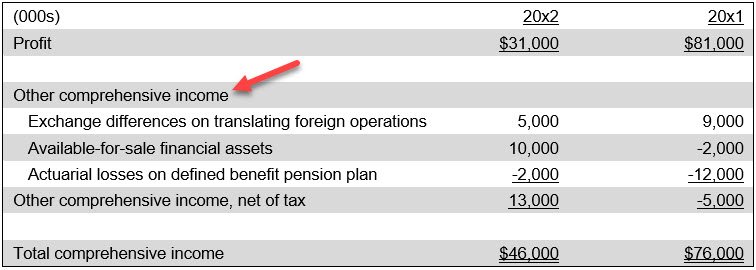

Other comprehensive income is those revenues, expenses, gains, and losses under both Generally Accepted Accounting Principles and International Financial Reporting Standards that are excluded from net income on the income statement. This means that they are instead listed after net income on the income statement. An example of the reporting presentation of other comprehensive income appears in the following exhibit.

Revenues, expenses, gains and losses appear in other comprehensive income when they have not yet been realized. Something has been realized when the underlying transaction has been completed, such as when an investment is sold. Thus, if your company has invested in bonds, and the value of those bonds changes, you recognize the difference as a gain or loss in other comprehensive income. Once you sell the bonds, you have then realized the gain or loss associated with the bonds, and can then shift the gain or loss out of other comprehensive income and into a line item higher in the income statement, so that it is a part of net income.

Other comprehensive income is designed to give the reader of a company's financial statements a more comprehensive view of the financial status of the entity, though in practice it is possible that it introduces too much complexity to the income statement. A non-accountant is unlikely to understand the line items included within this area of the financial statements.

Related AccountingTools Courses

The Interpretation of Financial Statements

What is Total Comprehensive Income?

Total comprehensive income is a measure of all changes in equity during a period, except those resulting from investments by or distributions to shareholders. It includes net income, which covers revenues minus expenses, as well as other comprehensive income. This broader measure provides investors and stakeholders with a clearer picture of a company’s financial performance and risk exposures by capturing elements that net income alone might overlook. Total comprehensive income is reported in a separate financial statement or as an extension of the income statement, thereby ensuring transparency in financial reporting.

Examples of Other Comprehensive Income

Examples of items that may be classified in other comprehensive income are as follows:

Unrealized gains and losses on available-for-sale securities. These are gains or losses from changes in the fair value of investments classified as available-for-sale. They are recorded in OCI until the securities are sold, at which point the gains or losses are transferred to net income.

Foreign currency translation adjustments. For companies with foreign subsidiaries, exchange rate fluctuations can create gains or losses when financial statements are converted into the parent company’s reporting currency. These adjustments are recorded in OCI to reflect the impact of exchange rate changes.

Unrealized gains and losses on cash flow hedges. When companies use derivatives to hedge against future cash flow risks, changes in the value of these hedges are recorded in OCI. This ensures that the impact of hedging activities is recognized when the underlying transaction affects earnings.

Pension plan adjustments. Actuarial gains and losses, prior service costs, and other adjustments related to defined benefit pension plans are recorded in OCI. This treatment smooths the impact of pension-related changes on net income.

Revaluation surplus (for IFRS users). Under International Financial Reporting Standards, companies may revalue fixed assets to fair value. Any surplus resulting from revaluation is recorded in OCI rather than directly in net income.

Presentation of Other Comprehensive Income

It is acceptable to either report components of other comprehensive income net of related tax effects, or before related tax effects with a single aggregate income tax expense or benefit shown that relates to all of the other comprehensive income items.