Under accrual definition

/What is an Under Accrual?

An under accrual is a situation in which the estimated amount of an accrual journal entry is too low. This scenario can arise for an accrual of either revenue or expense. Thus, an under accrual of an expense will result in more profit in the period in which the entry is recorded, while an under accrual of revenue will result in less profit in the period in which the entry is recorded.

An accrual is typically created as a reversing entry in the accounting software, so that the opposite of the original entry is recorded at the beginning of the following accounting period; this flushes the effect of the entry from the financial statements over the course of two accounting periods. This also means that an under accrual in one period leads to the reverse effect in the next period. Thus:

If there is an under accrual of $2,000 of revenue in April, then revenue will be too high by $2,000 in May.

If there is an under accrual of $4,000 of an expense in April, then the expense will be too high by $4,000 in May.

Auditors are always watching for potential under accruals of expenses, on the grounds that this creates too great a profit in the period being compiled, reviewed, or audited.

Related AccountingTools Courses

Example of an Under Accrual

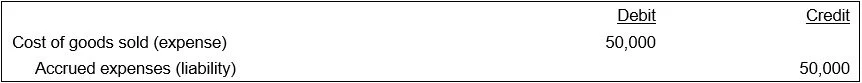

ABC International's accounting staff estimates that the billing from a key materials supplier will be $50,000 based on the amount of goods shipped to the company during the past month (April). The accounting staff uses this estimate to create a cost of goods sold accrual for $50,000, and sets it up as an automatically reversing entry, as follows:

At the beginning of the next month (May), the accounting system generates a reversing entry, which is:

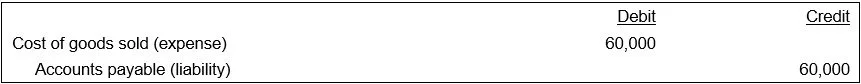

Later in May, the supplier sends ABC its April invoice for $60,000. The invoice is higher than expected, because ABC's accounting staff did not account for a large delivery from the supplier. The entry is:

Thus, ABC initially creates an accrual of $50,000 that is lower than the actual amount of the cost of goods sold by $10,000. The under accrual creates $10,000 too much profit in April, and $10,000 too much expense in May.