Over accrual definition

/What is an Over Accrual?

An over accrual is a situation where the estimate for an accrual journal entry is too high. This estimate may apply to an accrual of revenue or expense. Thus, an over accrual of revenue will result in an excessively high profit in the period in which the journal entry is recorded, while an over accrual of an expense will result in a reduced profit in the period in which the journal entry is recorded.

An accrual is usually set up as a reversing entry, which means that the exact opposite of the original entry is recorded in the accounting system at the beginning of the next accounting period. When an over accrual is recorded in one period, this means that the reversing entry causing the reverse effect applies in the next accounting period. Thus:

If there is an over accrual of $500 of revenue in January, then revenue will be too low by $500 in February.

If there is an over accrual of $1,000 of an expense in January, then the expense will be too low by $1,000 in February.

An over accrual is not good from the perspective of the auditor, since it implies that a company's accounting staff is not able to properly estimate the amounts of revenues and expenses for which it is creating accruals.

Related AccountingTools Courses

How to Avoid an Over Accrual

The presence of over accruals can be avoided by only making an accrual entry when the amount to be recorded is easily calculated. If the amount is subject to fluctuation, the most conservative figure should be recorded.

Example of an Over Accrual

ABC International's accounting staff estimates that the amount of its phone bill for the month of April will be $5,500, which is based on a recent history of approximately that amount per month over the past few months. The accounting staff accordingly creates the following entry, which it sets up as an automatically reversing entry:

| Debit | Credit | |

| Telephone expense | 5,500 | |

| Accrued expenses (liability) |

5,500 |

At the beginning of the next month (May), the accounting system generates a reversing entry, which is:

| Debit | Credit | |

| Accrued expenses (liability) |

5,500 | |

| Telephone expense |

5,500 |

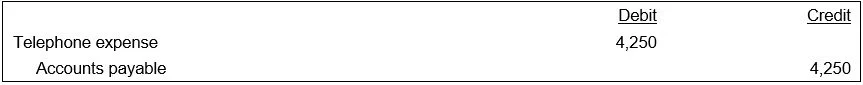

Finally, later in May, the phone company sends ABC the April phone bill in the amount of $4,250. The invoice is reduced because of a combination of a rate decrease and ABC having fewer land lines in use. The entry is:

Thus, ABC initially creates an accrual of $5,500 that exceeds the actual amount of the expense by $1,250. The over accrual creates $1,250 too much expense in April, and $1,250 too little expense in May.