Accrued payroll definition

/What is Accrued Payroll?

Accrued payroll is all forms of compensation owed to employees that have not yet been paid to them. It represents a liability for the employer. The accrued payroll concept is only used under the accrual basis of accounting; it is not used under the cash basis of accounting. The key components of accrued payroll are salaries, wages, commissions, bonuses, and payroll taxes.

How to Calculate Accrued Payroll

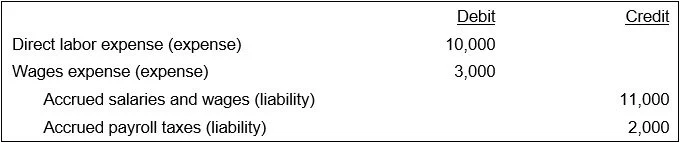

The amount of accrued payroll to record at the end of an accounting period is usually comprised of the compensation owed to hourly employees for the period from the last day paid through the end of the period, plus any payroll taxes related to those unpaid wages. Depending on the length of the payroll cycle, it is less common to have any accrued payroll for salaried employees, since they are frequently paid through the end of the accounting period. The following exhibit shows a sample entry that breaks out the accrual for direct labor (part of the cost of goods sold), while all other wages earned are listed in the wages expense line item.

Example of Accrued Payroll

A company’s employees work from March 25 to March 31, but their next payday is on April 5. As of March 31, the company owes employees wages for the last week of March, even though they will not be paid until April. If the total wages earned by employees during this period amount to $20,000, the company records an accrued payroll liability of $20,000 on its balance sheet as of March 31. When the company processes payroll on April 5, it reduces this liability and records the payment as an expense. This ensures that the company’s financial statements reflect all employee compensation owed, even if it has not yet been paid.

Advanced Payroll Accrual Concepts

When a company is engaged in a fast close, the payroll clerk may not want to spend the time to compile hours worked information at the end of an accounting period for the accrual calculation. Instead, the clerk can estimate hours worked based on historical records of hours worked per day, or the standard number of working hours per day. These estimates can be incorrect if the actual hours worked are unusually high or low, but the difference from the estimate used in the accrued payroll figure is usually immaterial.

When accrued payroll includes a provision for payroll taxes, be aware that accruals later in the calendar year may need to be reduced for those payroll taxes that are capped at a certain amount of annual wages; once that cap is reached, there is no further payroll tax liability. For example, unemployment taxes are usually based on quite a low annual wage cap that may be met within the first few months of the year. There is also a wage cap associated with the social security tax, but that cap is only exceeded by highly-paid employees.