Notes payable definition

/What are Notes Payable?

A note payable is a written promissory note. Under this agreement, a borrower obtains a specific amount of money from a lender and promises to pay it back with interest over a predetermined time period. The interest rate may be fixed over the life of the note, or vary in conjunction with the interest rate charged by the lender to its best customers (known as the prime rate). This differs from an account payable, where there is no promissory note, nor is there an interest rate to be paid (though a penalty may be assessed if payment is made after a designated due date).

Presentation of Notes Payable

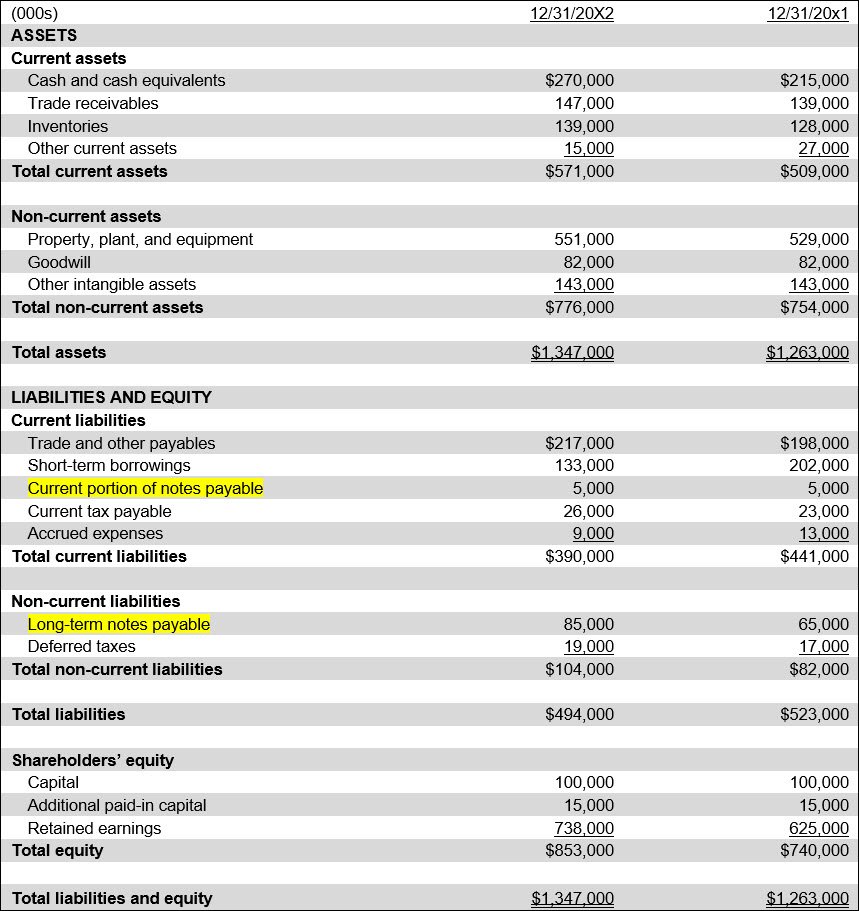

A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability. The following exhibit highlights these presentation differences.

The proper classification of a note payable is of interest from an analyst's perspective, to see if notes are coming due in the near future; this could indicate an impending liquidity problem.

Related AccountingTools Courses

Accounting for Notes Payable

When a company borrows money under a note payable, it debits a cash account for the amount of cash received, and credits a notes payable account to record the liability. For example, a bank loans ABC Company $1,000,000; ABC records the entry as follows:

| Debit | Credit | |

| Cash | 1,000,000 | |

| Notes payable | 1,000,000 |

The note has a 5% interest rate, payable quarterly to the bank. ABC Company records the quarterly accrual of the interest expense as follows:

| Debit | Credit | |

| Interest expense | 12,500 | |

| Interest payable | 12,500 |

ABC wires funds to the bank to pay for the interest expense, and records the following entry:

| Debit | Credit | |

| Interest payable | 12,500 | |

| Cash | 12,500 |

On the date specified in the agreement, ABC pays the $1,000,000 loan back to the lender, and records the following entry:

Legal Issues Pertaining to Notes Payable

The lender may require restrictive covenants as part of the note payable agreement, such as not paying dividends to investors while any part of the loan is still unpaid. If a covenant is breached, the lender has the right to call the loan, though it may waive the breach and continue to accept periodic debt payments from the borrower. The agreement may also require collateral, such as a company-owned building, or a guarantee by either an individual or another entity. Many notes payable require formal approval by a company’s board of directors before a lender will issue funds.

An example of a notes payable is a loan issued to a company by a bank.

Terms Similar to Notes Payable

A note payable is also known as a loan or a promissory note.

Related Articles

Accounting for a Non Interest Bearing Note

Accounting for Debt Issuance Costs

How to Record a Loan Payable that Includes Interest and Principal