Accumulated retained earnings definition

/What are Accumulated Retained Earnings?

Accumulated retained earnings are the earnings of a business that have piled up since its inception, rather than being paid to shareholders in the form of dividends or some other form of distribution. Many organizations maintain quite large accumulated retained earnings balances, both to invest in ongoing operations and to maintain a reserve of cash against future requirements.

Advantages of Having Accumulated Retained Earnings

It is necessary to build up a significant amount of accumulated retained earnings in many companies, for the following reasons:

Reserves. It is prudent to maintain a significant reserve of funds against the day when there is a decline in profitability.

Self insurance. A company may need a reserve of cash, in case it is self-insuring against certain losses for which it must eventually pay.

Growth. A rapidly-growing business consumes an inordinate amount of cash, because additional accounts receivable and inventory must be funded to support the growth.

Debt paydown. Excess funds can be used to pay down debt, which eliminates the associated amount of interest expense and therefore makes the capital structure of the business less risky.

Appropriation. The board of directors may appropriate some portion of retained earnings, which sets aside the designated funds for a specific use, such as for self-constructed assets.

Related AccountingTools Course

Investors may not have a problem with the accumulation of retained earnings, especially when the cash not being distributed is instead used to fund an expansion of the business. In this case, investors are instead earning a return on their invested funds by experiencing an increase in the market price of the shares they hold in the business. However, investors will not be pleased with a large amount of accumulated retained earnings if bad management of the company has led to a decline in financial results that has not triggered an increase in the price of company shares.

A company must be careful to justify the amount of its accumulated retained earnings, since some governments tax an excessive amount of these accumulated earnings, on the grounds that they should have been distributed to shareholders (who would then have been taxed for their dividend income).

How to Calculate Accumulated Retained Earnings

The calculation of accumulated retained earnings is to add the beginning retained earnings balance to any profit earned in the period, subtract out any loss incurred in the period, and subtract out any dividends paid in the period. The formula is as follows:

Beginning retained earnings + Current period profits/losses - Current period dividends

= Accumulated retained earnings

Example of Accumulated Retained Earnings

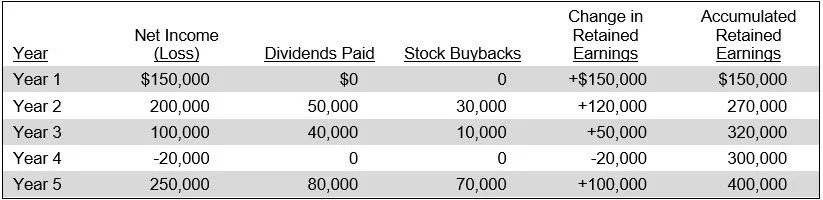

The following example shows how a variety of transactions can alter the accumulated retained earnings of a business over a period of time, due to changes in profits, dividend payments, and stock buybacks.

Terms Similar to Accumulated Retained Earnings

Accumulated retained earnings is also known as earned surplus or unappropriated profit.