Property, plant, and equipment definition

/What is Property, Plant, and Equipment?

Property, plant, and equipment (PP&E) includes tangible items that are expected to be used in more than one reporting period and that are used in production, for rental, or for administration. This can include items acquired for safety or environmental reasons. In certain asset-intensive industries, PP&E is the largest class of assets.

Classifications of Property, Plant, and Equipment

PP&E items are commonly grouped into classes, which are groups of assets having a similar nature and use. Within the PP&E name, the classifications are as follows:

Property. This classification includes land, land improvements, and buildings. This can be the single largest asset class for a land-oriented business, such as a distributor or a farming operation. Conversely, it may be rarely used by an asset-light business that deals with software development or other tangible assets.

Plant. This classification includes industrial facilities. This classification is most heavily used by manufacturers.

Equipment. This is a catchall classification that includes equipment, computers and software, furniture and fixtures, and office equipment. It is the central asset classification for most businesses that are not manufacturers or distributors.

Most businesses do not use the preceding PP&E classifications, because they are too broad. Instead, they use classifications that are more narrowly focused. Examples of these classifications are buildings, furniture and fixtures, land, machinery, and motor vehicles. Items grouped within a class are typically depreciated using a common depreciation calculation. Many items grouped into a PP&E class are assigned the same useful life for depreciation purposes.

Related AccountingTools Courses

Accounting for Property, Plant, and Equipment

When recording an item within PP&E, include in its cost the purchase price of the asset and related taxes, as well as any related construction costs, import duties, freight and handling, site preparation, and installation. When an item has a relatively low cost, it is typically charged to expense rather than being recorded in PP&E, in order to reduce the asset tracking work of the accounting department; the threshold below which items are charged to expense is called the capitalization limit.

Once an asset has been recorded, it is depreciated over its useful life. Depreciation is a consistently-applied charge that is intended to reflect the use of an asset over time. By the end of an asset’s useful life, its remaining book value should be zero. When an asset is eventually retired, its asset value and the accumulated amount of depreciation expense associated with it are eliminated from the accounting records.

Presentation of Property, Plant, and Equipment

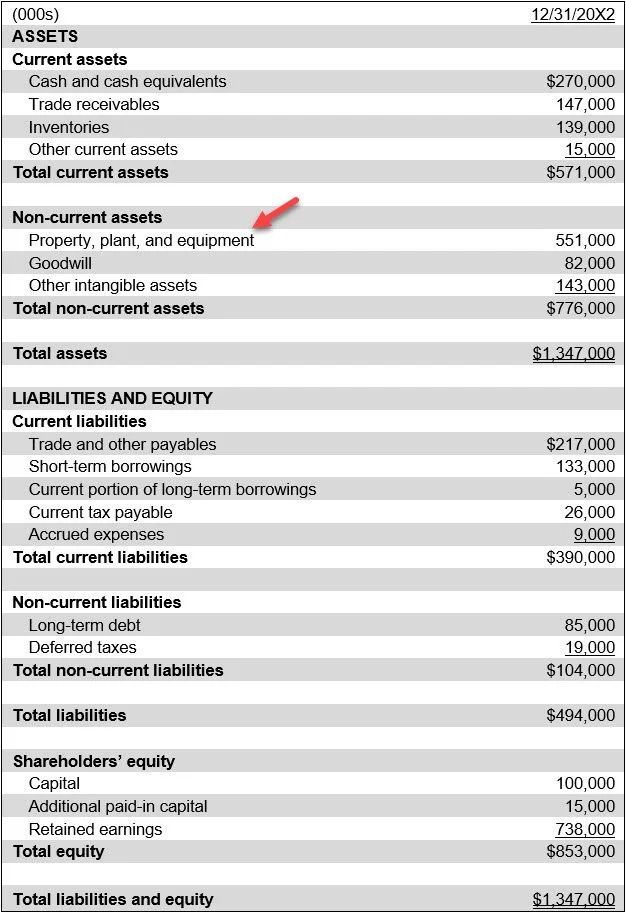

The property, plant, and equipment asset line item is stated in the balance sheet as a non-current asset, and is typically offset by an accumulated depreciation line item. The accumulated depreciation is a contra account, and reduces the balance in the PP&E line item. A simplified presentation that merges the PP&E total and accumulated deprecation into one line item is highlighted in the following exhibit, which contains a balance sheet.