Nonprofit accounting definition

/What is Nonprofit Accounting?

Nonprofit accounting is the process of recording and reporting a nonprofit organization's financial activities. Unlike for-profit accounting, the focus is not on generating profit, but rather on tracking how funds are received and used to support the mission. Key components include fund accounting, which separates resources by purpose (e.g., restricted vs. unrestricted funds), and producing specialized reports like the Statement of Financial Position and Statement of Activities. Accurate accounting by the nonprofit accountant helps to ensure an organization’s financial sustainability and public confidence.

Nonprofit Accounting Key Concepts

Nonprofit accounting employs the following concepts that differ from the accounting by a for-profit entity:

Net assets. Net assets take the place of equity in the balance sheet, since there are no investors to take an equity position in a nonprofit.

Donor restrictions. Net assets are classified as being either with donor restrictions or without donor restrictions. Assets with donor restrictions can only be used in certain ways, frequently being assigned only to specific programs. Assets without donor restrictions can be used for any purpose.

Programs. A nonprofit exists in order to provide some kind of service, which is called a program. A nonprofit may operate a number of different programs, each of which is accounted for separately. By doing so, one can view the revenues and expenses associated with each program.

Management and administration. Costs may be assigned to the management and administration classification, which refers to the general overhead structure of a nonprofit. Donors want this figure to be as low as possible, which implies that the bulk of their contributions are going straight to programs.

Fund raising. Costs may be assigned to the fund raising classification, which refers to the sales and marketing activities of a nonprofit, such as solicitations, fund raising events, and writing grant proposals. There is some pressure to keep these reported costs as low as possible, so that donors will think that the organization is being efficient in directing most of their funds toward programs.

Financial statements. The financial statements produced by a nonprofit entity differ in several respects from those issued by a for-profit entity. For example, the statement of activities replaces the income statement, while the statement of financial position replaces the balance sheet. Both for-profit and nonprofit entities issue a statement of cash flows. Finally, there is no nonprofit equivalent for the statement of stockholders' equity, since a nonprofit has no equity.

Budgeting. A budget is not necessarily used in a for-profit business, but is considered an essential component of the accounting for a nonprofit business. This is because a nonprofit typically has quite limited revenue sources, and so must maintain tight control over its expenditures at all times. Consequently, its budget must be rigorously developed based on reasonable revenue expectations, with all cost variances being promptly investigated.

Related AccountingTools Courses

Nonprofit Financial Statements

There are a number of individuals and other entities that want to view a nonprofit organization’s financial condition and ability to provide services. This information is provided through the financial statements, which use a standardized format to describe the financial results, financial position, and cash flows of an organization. A nonprofit issues financial statements that are somewhat different in name and structure from those used by for-profit entities. The following exhibit compares the financial statements used by these two types of organizations:

The Statement of Activities

The primary intent of a nonprofit is (as the name implies) something other than earning a profit. Consequently, a nonprofit does not issue an income statement, as does a for-profit business. Instead, a nonprofit issues an alternative called a statement of activities. This statement quantifies the revenue and expenses of a nonprofit for a reporting period. These revenues and expenses are broken down into the “without donor restrictions” and “with donor restrictions” classifications, and which are divided into separate columns across the statement. The rows in the statement reveal revenues and expenses. A sample statement of activities appears in the following exhibit.

The Statement of Financial Position

A nonprofit needs to report the state of its assets and liabilities as of the end of each reporting period, as well as provide an indication of its ability to meet its financial obligations. In a for-profit business, the financial statement used to report this information is the balance sheet. A nonprofit entity reports similar information in the statement of financial position. The main difference between a balance sheet and a nonprofit’s statement of financial position is that the balance sheet contains a shareholders’ equity section, which is replaced by a net assets section in the statement of financial position. A sample statement of financial position appears in the following exhibit.

The Statement of Cash Flows

The statement of cash flows contains information about the flows of cash into and out of a nonprofit; in particular, it shows the extent of those nonprofit activities that generate and use cash. This information is useful for donors, who may want to know how their contributed funds are used. A sample statement of cash flows appears in the following exhibit.

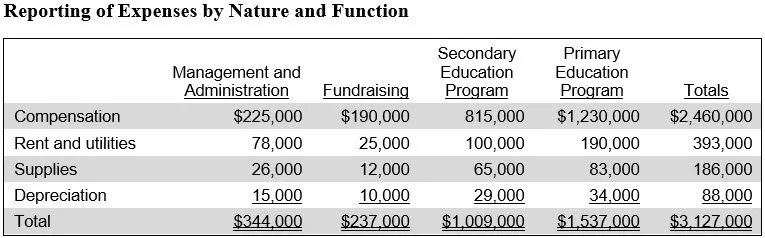

Reporting of Expenses by Nature and Function

It can be useful for a nonprofit to report its expenses by nature and function. This presentation is used to show how expenses are incurred for each functional area of the business. Information reported by nature means that a line item is presented that contains expense results, such as for salaries, rent, electricity, supplies, interest expense, and so forth. A sample presentation of this report appears in the following exhibit.