Quick ratio analysis

/What is the Quick Ratio?

The quick ratio, also known as the acid-test ratio, is a financial metric used to assess a company’s short-term liquidity and its ability to meet immediate obligations without relying on the sale of inventory. It is calculated by dividing quick assets (cash, marketable securities, and accounts receivable) by current liabilities.

A quick ratio greater than 1 indicates that a company has sufficient liquid assets to cover its short-term liabilities, suggesting financial stability. Conversely, a ratio below 1 may signal potential liquidity risks, implying that the company might struggle to meet immediate obligations if they come due. Unlike the current ratio, the quick ratio excludes inventory from assets, providing a more conservative view of a company’s ability to pay its short-term debts quickly.

What is Quick Ratio Analysis?

Quick ratio analysis is used to examine the ability of a business to pay its bills. In essence, any quick ratio of 2:1 or better shows that a company is likely able to pay its short-term obligations. This is an essential analysis for lenders and creditors, who will not extend credit unless they believe they will be paid back on time.

How to Calculate the Quick Ratio

The quick ratio is based on those assets and liabilities on a company's balance sheet that are most liquid, which usually results in the following formula:

(Cash + Marketable securities + Accounts receivable) ÷ Accounts payable = Quick ratio

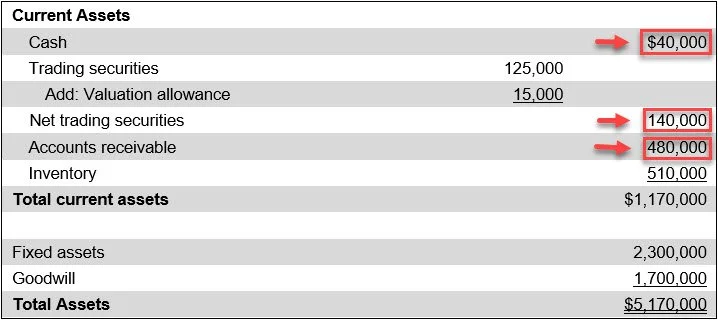

The line items in the balance sheet that are used for this measure are highlighted in the following exhibit.

The exact contents of the ratio can vary, depending on the types of assets and liabilities that a company holds. The main point of constructing the ratio in this manner is to avoid the more illiquid assets, which means inventory and fixed assets. By doing so, we focus on the cash that should be available in the short term to the cash requirements of a business in the short term.

Related AccountingTools Courses

Quick Ratio vs. Current Ratio

The quick ratio is better than the current ratio, which includes inventory. It can be quite difficult to liquidate inventory in a timely manner to pay for short-term obligations, so the current ratio can be a misleading indicator of short-term liquidity. Conversely, since the quick ratio focuses on assets that can actually be liquidated in short order, it is a better indicator of how much cash can be raised in the short term to pay for current obligations.

Problems with Quick Ratio Analysis

The quick ratio can be misleading. Consider the following issues with it:

Window dressing. If a company knows that its quick ratio is being reviewed by a creditor or lender, it can take certain steps to make the ratio look better than it really is, by delaying the timing of payments and the recognition of supplier invoices. You can sidestep this problem by requesting sufficient information to calculate the ratio for many periods in the past, when the company was presumably not engaged in altering its reported results. Viewing the ratio on a trend line will make it more apparent that window dressing is being used in the current period.

Forward looking. The quick ratio, like most ratios, is based on historical information, and so gives no guidance into the future prospects of a business. You can sidestep this issue to some extent by also tracking the company's trend line of customer orders, which is intended to provide guidance about future results.

Payment exclusions. The quick ratio does not consider other types of liabilities that may require payment in the short term, such as a lawsuit settlement, a dividend payment, or the purchase of an expensive fixed asset. These payments can drain a company's cash account, so that the next quick ratio has a decidedly worse outcome than the ratio calculated for the preceding reporting period. Some of these payouts are indeed unexpected, but others (such as dividend payments) can be anticipated by reviewing the company's history of such payments.