How to account for accrued rent

/Accrued rent is the amount of unpaid rent owed by a renter or not yet collected by the landlord. If rent is paid on time, then there is never any accrued rent. The accounting for accrued rent from the perspectives of the landlord and the renter are noted below.

Landlord Accounting

The landlord typically has rental agreements in place where rent payments are to be made at the beginning of the month in which renting occurs. This means that the receipt of cash from renters generally coincides with the period in which it is also recognized as revenue. Thus, there is no need to accrue rental income. However, if a renter does not pay in the rent period, the landlord should accrue the rent in that accounting period, with a debit to an accrued billings (asset) account and a credit to a rent revenue account. This is normally set up as a reversing entry, so that the original entry is automatically reversed at the beginning of the following accounting period, thereby eliminating the risk that it will linger in the accounting records and result in duplicate revenue.

However, since the renter in question should have paid in advance and is now a full month late in paying by the end of the accounting period, it may also be necessary to create a substantial reserve against the presumed receivable, with a debit to the bad debt expense account and a credit to the allowance for doubtful accounts. A landlord's experience with these late payments may be so bad that it makes more sense to not accrue them at all, and instead only record revenue upon the receipt of cash (which is inclined more toward the cash basis of accounting). This latter situation tends not to last long, since the renter will have violated the terms of the rental agreement, and can then be evicted.

Related AccountingTools Courses

Property Management Accounting

Renter Accounting

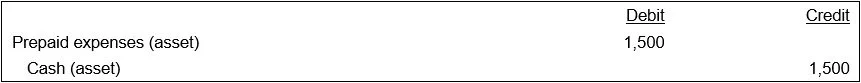

From the perspective of the renter, a rent payment for the next month may sometimes be made at the end of the immediately preceding month. If so, "accrued rent" essentially means prepaid rent. In this case, the renter records a debit to the prepaid expenses (asset) account and a credit to the cash account. A sample entry follows, which assumes a $1,500 rent payment.

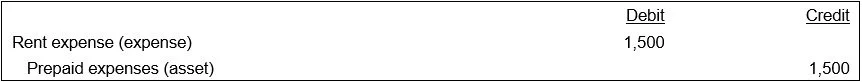

When the renter is preparing its financial statements for the month to which the rent payment applies, the rent expense account is debited and the prepaid expenses account is flushed out with a credit, so that rent expense is recognized in the correct month. The following entry shows how the renter in the preceding example would record the $1,500 of rent expense for the month in which the rent applies.

A renter frequently sets up a schedule of rent payments in its accounts payable software module, so that the same payment is made on the same day of each month until a predetermined termination date is reached. The same journal entry is automatically generated for each of these recurring payments, which greatly reduces the need to review the accuracy of accrued rent entries in each accounting period.