Functional expense classification definition

/What is the Functional Expense Classification?

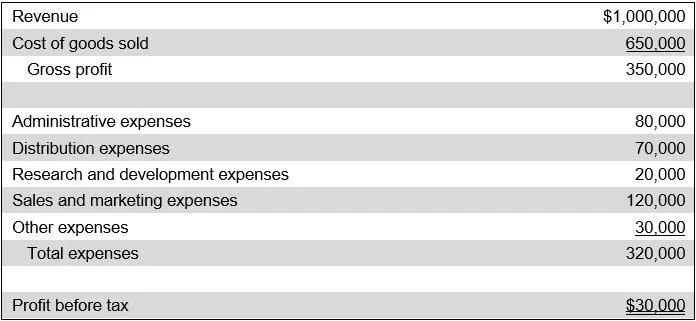

The functional expense classification is a sorting and presentation method used in accounting, under which expenses are aggregated and reported by the activities for which they were incurred. For example, expenses could be aggregated by department and then reported as (for example) administrative expenses and selling expenses. This approach is most commonly used by larger businesses, which are likely organized into many departments. An income statement that uses the functional expense classification appears in the following exhibit.

What is the Natural Expense Classification?

Under the natural expense classification, expenses are aggregated and reported by their type. Examples are benefits expense, compensation expense, and depreciation expense. This reporting approach is most commonly followed by smaller businesses, which do not have separate departments into which expenses can be sorted.

Related AccountingTools Course

FAQs

How Do Functional Expenses Differ From Natural Expenses?

Functional expenses classify costs by their purpose, such as whether they support program services, fundraising, or management and general activities. Natural expenses, on the other hand, classify costs by their type or nature, such as salaries, rent, utilities, or supplies. The key difference is that functional classification shows why money is spent, while natural classification shows what the money is spent on.