Functional accounting definition

/What is Functional Accounting?

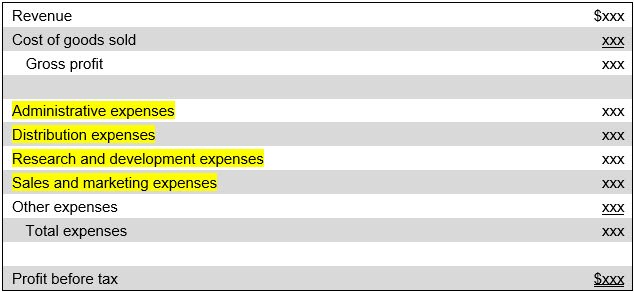

Functional accounting is a reporting format for financial results that clusters results based on the functions performed. This approach is most commonly used to cluster expenses by department, and is commonly used in larger or more complex organizations. For example, a company's expenses may be grouped together in the income statement as follows:

Accounting and finance department

Engineering department

Human resources department

Materials management department

Production department

Sales department

Expenses are clustered together in this manner in order to track and evaluate the performance of individual departments. Thus, functional accounting is a form of responsibility accounting, since the manager of a department is responsible for the expenses charged to his or her department. An example of the functional accounting approach in the presentation of a sample income statement is noted next, where department expenses are highlighted.

Chart of Accounts Numbering

In order to report expenses by function, it is necessary to restructure the chart of accounts of a business. For example, a normal chart of accounts might have a single rent expense account, with a single account code assigned to it. In a functional accounting environment, there must be a separate rent expense designation for each department, so that rent can be allocated to each department. This greatly increases the total number of accounts listed in the chart of accounts. An example follows.

Rent expense - Accounting (#7600-100)

Rent expense - Engineering (#7600-200)

Rent expense - Materials management (#7600-300)

Rent expense - Production (#7600-400)

Rent expense - Sales (#7600-500)

The report writing software in the accounting system then accumulates all expenses based on the department codes in the chart of accounts and uses it to assemble an income statement that is based on functional activities.

Problems with Functional Accounting

While functional accounting can be quite useful in certain situations, there are also some problems with it, which are as follows:

Complexity in cost allocation. Assigning expenses to specific functions can be difficult and subjective. This is a particular concern with indirect costs (e.g., utilities, rent), which may need arbitrary allocation methods. Some expenses, like IT and HR, support multiple functions, which makes it hard to assign costs fairly.

Potential for manipulation. Management may misallocate expenses to functions to manipulate financial performance. For example, shifting overhead costs into a capitalized asset increases the reported profit level.

Less relevant for small businesses. Functional accounting is more useful for large corporations with multiple departments. Small businesses may find it unnecessary and overly complex.

Increased administrative burden. Functional accounting requires detailed cost tracking, resulting in more work for the accounting department.

While functional accounting improves cost tracking and decision-making, its complexity and potential for expense misallocation can make it difficult to implement effectively.