Financial statements of nonprofits

/What are the Key Financial Statements for a Nonprofit?

A nonprofit entity issues a somewhat different set of financial statements than the statements produced by a for-profit entity. One of the statements is entirely unique to nonprofits. The financial statements issued by a nonprofit are noted below.

Statement of Financial Position

The statement of financial position is similar to the balance sheet of a for-profit entity, except that a net assets section takes the place of the equity section that a for-profit entity uses. The net assets section breaks out net assets with donor restrictions and net assets without donor restrictions. A sample report appears next.

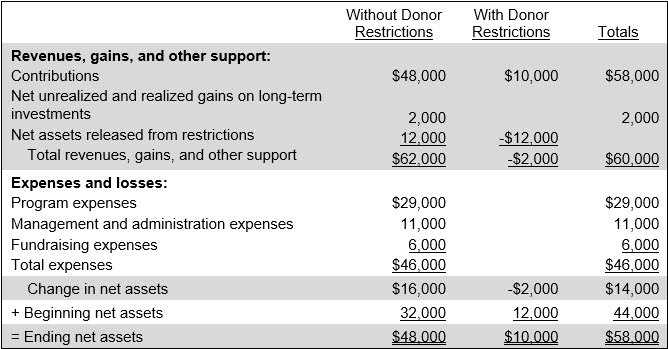

Statement of Activities

The statement of activities quantifies the revenues and expenses of a nonprofit for a reporting period. These revenues and expenses are broken down into the “Without Donor Restrictions” and “With Donor Restrictions” classifications that were referred to earlier for the statement of financial position. A sample report appears next.

Statement of Cash Flows

The statement of cash flows contains information about the flows of cash into and out of a nonprofit; in particular, it shows the extent of those nonprofit activities that generate and use cash. A sample report appears next.

Statement of Functional Expenses

The statement of functional expenses shows how expenses are incurred for each functional area of the business. Functional areas typically include management and administration, fund raising, and programs. It helps donors, grant providers, and regulatory bodies understand how funds are being spent in different areas of an organization.

This statement is not used by for-profit organizations. A sample report appears next.