Earnings before taxes definition

/What are Earnings Before Taxes?

Earnings before taxes is a measure of the earnings generated by a business before making any tax payments to the government. This measure includes the results of both operations and any financing activities, such as the cost of debt, and so is a good measure of the aggregate results of a business. It is a useful measure for investors and analysts, who can use it to compare the results of businesses located in different tax jurisdictions. Since tax rates vary by jurisdiction, the earnings before taxes number normalizes reported earnings for easier comparison.

How to Calculate Earnings Before Taxes

To calculate earnings before taxes, start with a company’s revenues and subtract the cost of goods sold to determine gross profit. From gross profit, subtract operating expenses such as salaries, rent, utilities, and depreciation to find operating income. Then, adjust for any non-operating income or expenses, such as interest income, interest expense, or gains and losses from investments. The result is the company’s earnings before taxes. In short, earnings before taxes represents the profit a company earns before paying income taxes and is calculated as follows:

Earnings before taxes = Revenue – Cost of goods sold – Operating expenses ± Non-operating Items

Presentation of Earnings Before Taxes

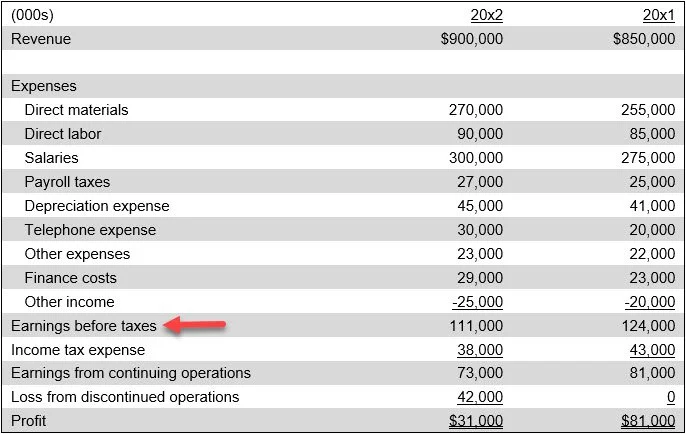

Earnings before taxes appears as a separate line item near the bottom of the income statement, prior to any adjustments for taxes. A sample of this presentation appears in the following exhibit.