Dollar-value LIFO method definition

/What is the Dollar-Value LIFO Method?

The dollar-value LIFO method is a variation on the last in, first out cost layering concept. In essence, the method aggregates cost information for large amounts of inventory, so that individual cost layers do not need to be compiled for each item of inventory. Instead, layers are compiled for pools of inventory items. Under the dollar-value LIFO method, the basic approach is to calculate a conversion price index that is based on a comparison of the year-end inventory to the base year cost. The focus in this calculation is on dollar amounts, rather than units of inventory.

The Conversion Price Index

The key concept in the dollar-value LIFO system is the conversion price index. To calculate the index, follow these steps:

Calculate the extended cost of the ending inventory at base year prices.

Calculate the extended cost of the ending inventory at the most recent prices.

Divide the total extended cost at the most recent prices by the total extended cost at base year prices.

Related AccountingTools Courses

These calculations yield an index that represents the change in prices since the base year. The calculation should be derived and retained for each year in which a business uses the LIFO method. This documentation will be needed to justify the period-end inventory costing calculation. Once the index is available, follow these additional steps to determine the cost of the LIFO cost layer in each successive period:

Determine any incremental increases in units of inventory in the next reporting period.

Calculate the extended cost of these incremental units at base year prices.

Multiply the extended amount by the conversion price index. This yields the cost of the LIFO layer for the next reporting period.

The method can be used to create separate indexes for a number of different pools of inventory. However, since doing so increases the labor associated with calculating and applying conversion price indices, it is better to minimize the number of inventory pools employed.

Example of Dollar-Value LIFO

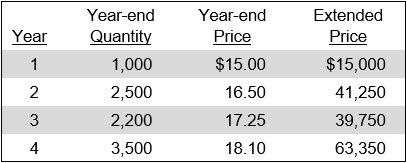

Entwhistle Electric has had the same cell phone battery version in stock for the past four years. The company uses the dollar-value LIFO method. Entwhistle’s inventory database contains the following quantity and pricing information for the battery:

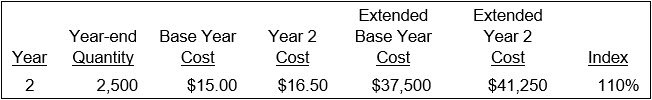

The first year is designated as the base year for purposes of creating the index in later years. The current price index for Year 2 is calculated as follows:

In Year 2, the incremental amount of cell phone batteries added to stock is 1,500 units. To arrive at the cost of the Year 2 LIFO layer, Entwhistle’s controller multiplies the 1,500 units by the base year cost of $15.00 and again by the 110% index to arrive at a layer cost of $24,750. In total, at the end of Year 2, Entwhistle has a base layer cost of $15,000 and a Year 2 layer cost of $24,750, for a total inventory valuation of $39,750.

In Year 3, there is a decline in the ending inventory unit count, so there is no new layer to calculate. Instead, the controller assumes that the units sold off are from the most recent inventory layer, which is the Year 2 layer. To calculate the year-end inventory valuation, we multiply the presumed residual balance of 1,200 units from the Year 2 layer by the $15.00 base year cost, and again by the 110% index, to arrive at a revised layer cost of $19,800. When combined with the $15,000 cost of the base layer, Entwhistle now has an ending inventory valuation of $34,800.

In Year 4, the inventory level has increased, which calls for the calculation of a new index. The calculation for the Year 4 current price index is:

There is an incremental increase in Year 4 from Year 3 of 1,300 units. The controller multiplies this amount by the $15.00 base year cost and again by the 121% current cost index to arrive at a cost for this new inventory layer of $23,595.

After four years of inventory accumulation under the dollar-value LIFO method, the ending inventory is comprised of the following LIFO inventory layers:

Disadvantages of the Dollar-Value LIFO Method

The dollar-value LIFO method is not commonly used to derive inventory valuations, for several reasons. These disadvantages are as follows:

Complex calculation. This approach requires detailed record-keeping of inventory pools and cost indexes. For this reason, it is more difficult to implement than other inventory methods like FIFO or weighted average costing.

Inflation index issues. This method relies on price indexes to adjust inventory values, which may not always reflect actual cost changes.

Not suitable for fluctuating inventories. Businesses with frequent inventory changes may struggle to maintain accurate cost layers. If incorrect or inappropriate indexes are used, this can lead to distorted financial results.

May not reflect true inventory value. Since this method assumes that newer, higher-cost inventory is sold first, it often understates inventory values on the balance sheet.

Can distort profitability. In times of deflation, this method may overstate profits and increase tax liabilities. Alternatively, it can reduce net income artificially when inventory costs rise sharply, making financial performance look weaker than it actually is.

Regulatory issues. The dollar-value LIFO method is not permitted under IFRS (International Financial Reporting Standards), which limits its global applicability.

The complexity, risk of LIFO liquidation, and compliance challenges make the dollar-value LIFO method less suitable for businesses with fluctuating inventory or those operating internationally.