Depreciation, depletion, and amortization (DD&A)

/What is Depreciation, Depletion, and Amortization?

Depreciation, depletion, and amortization (D&A) refers to the set of techniques used to gradually charge certain costs to expense over an extended period of time. More specifically:

Depreciation. This is the planned, gradual reduction in the recorded value of a tangible asset over its useful life. The use of depreciation is intended to spread expense recognition for fixed assets over the period of time when a business expects to earn revenue from those assets.

Depletion. This refers to the actual physical reduction of a natural resource. All of these terms are classified as non-cash expenses, since no cash outflows occur when these charges are made.

Amortization. This is the same concept as depreciation, but is applied to the consumption of an intangible asset over its useful life. In the oil and gas industry, amortization is used more broadly to refer to the ongoing expensing of properties, wells and equipment so that it becomes part of the cost of the oil and gas produced.

All three terms are used in the oil and gas industry, where the term DD&A has arisen to refer to all three types of expense recognition. DD&A is used somewhat differently, depending upon whether an organization is employing the successful efforts method or the full cost method. These differences are noted below.

Related AccountingTools Courses

DD&A Under the Successful Efforts Method

Under the successful efforts method, if proved reserves are discovered on a property, the related costs that had been compiled within the unproved property classification are shifted into the proved property classification. Similarly, the costs compiled for successful exploratory wells and completed development wells are shifted from the wells-in-progress classification to the wells and equipment classification. Once these reclassifications have been completed, the assets are subject to DD&A, where the following rules apply:

Proved reserves are used to amortize the acquisition costs of proved property. These reserves include oil and gas that will be produced from existing wells, and from wells that will be drilled at a later date.

Proved developed reserves are used to amortize the costs of wells and equipment, since these reserves are related to only those reserves that can be accessed with existing wells and equipment.

The amounts of proved reserves and proved developed reserves will differ when a property is still under development, and will be the same amount when the property is fully developed, with all wells drilled.

DD&A Under the Full Cost Method

When using the full cost method, the accountant should be aware of several differences from the DD&A calculations employed for the successful efforts method. They are as follows:

Future development costs needed to convert proved undeveloped reserves into proved developed reserves should be included in the costs being amortized.

Estimated future decommissioning costs of well sites, net of estimated salvage values, are to be included in the cost base used to calculate DD&A. These costs would include such activities as the dismantlement of drilling equipment and land reclamation activities.

Costs that have been invested in unevaluated, unproved properties and major development projects are not capitalized into a cost center that will be amortized. Instead, these costs are withheld from the amortization calculation until such time as a determination can be made as to whether proved reserves can be assigned to the properties.

The unit of revenue method can be used instead of the unit of production method. This calculation is essentially the current gross revenue divided by future gross revenues.

The designated cost center under the full cost method is likely to be an entire country, which means that support equipment and facilities will be assigned to a single cost center. That being the case, support equipment and facilities will very likely be depreciated using the unit of production method.

Presentation of Depreciation, Depletion, and Amortization

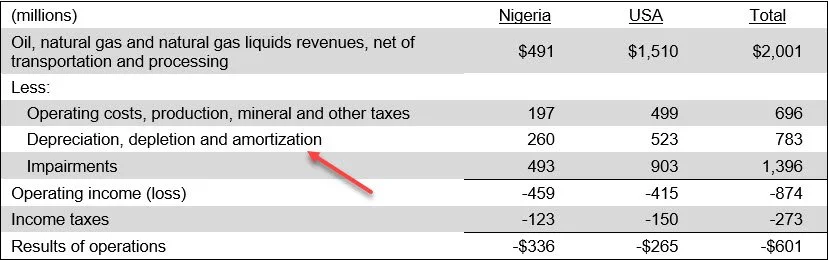

An oil and gas business is required to disclose the amount of its depreciation, depletion and amortization expense in its financial statements. A sample of this presentation appears in the following exhibit.