Declining balance method definition

/What is the Declining Balance Method?

A declining balance method is used to accelerate the recognition of depreciation expense for assets during the earlier portions of their useful lives. This leaves less depreciation expense to be recognized later in their useful lives. To calculate depreciation under a declining method, multiply the book value of an asset at the beginning of the fiscal year by a multiple of the straight-line rate of depreciation. Examples of declining balance methods are the 150% declining balance method and the double declining balance method.

Example of the Declining Balance Method

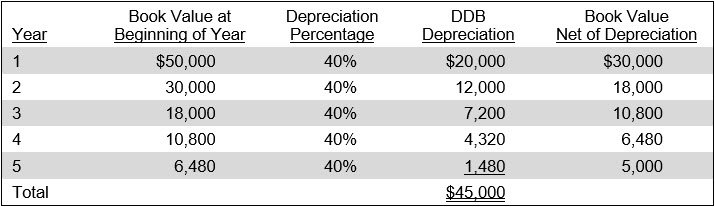

Pensive Corporation purchases a machine for $50,000. It has an estimated salvage value of $5,000 and a useful life of five years. The calculation of the double declining balance depreciation rate is:

(100%/Years of useful life) × 2 = 40%

By applying the 40% rate, Pensive arrives at the following table of depreciation charges per year:

Note that the depreciation in the fifth and final year is only for $1,480, rather than the $3,240 that would be indicated by the 40% depreciation rate. The reason for the smaller depreciation charge is that Pensive stops any further depreciation once the remaining book value declines to the amount of the estimated salvage value.

When to Use the Declining Balance Method

There are a number of situations in which it makes sense to use a declining balance method to depreciate an asset. Here are the primary scenarios:

When assets lose value quickly. For assets that rapidly lose value in the first few years, such as technology or vehicles, the declining balance method aligns better with their actual usage and resale value. This approach captures the reality that these assets often become obsolete or significantly less valuable sooner.

To match expenses with revenue generation. When assets generate more revenue in their early years, it makes sense to match higher depreciation expenses to those higher revenues. This is common for manufacturing equipment that operates at peak efficiency when new, supporting a more accurate picture of profitability.

For tax advantages. Accelerated depreciation methods, like the declining balance method, allow businesses to claim higher expenses earlier, reducing taxable income in the short term. This can improve cash flow by deferring tax liabilities, providing a financial cushion for reinvestment.

In capital-intensive industries. Industries such as construction, transportation, and manufacturing often invest in expensive equipment that wears out quickly. Using a declining balance method helps these businesses manage costs effectively by recognizing higher depreciation expenses when equipment usage and maintenance costs are lower.

When replacement cycles are short. If a company plans to replace its assets frequently, accelerated depreciation ensures that a significant portion of the asset’s cost is recognized before it’s retired or sold. This prevents large book losses when older assets are disposed of.

When maintenance costs rise over time. Assets that require minimal maintenance when new but incur higher repair costs as they age are well-suited for declining balance depreciation. This method balances total expense recognition by offsetting increasing maintenance costs with decreasing depreciation expenses over time.

In short, the declining balance method is beneficial for businesses managing rapidly depreciating assets, seeking tax benefits, or looking to match expenses with revenue more accurately in an asset's early years.

Related AccountingTools Courses

Effects of the Declining Balance Method

When large amounts of depreciation are being recognized early in the life of an asset, this means that the carrying amount of the asset is severely reduced within a short period of time. If the asset is sold within a few years of its acquisition, this can result in the recognition of a large gain, since the carrying amount of the asset is likely to be well below its market value. When this happens, the gains being recognized do not mean that the company is getting great prices on the assets it sells - only that their carrying amounts are quite low.

Advantages of the Declining Balance Method

The main advantage of the declining balance method is that it results in a lower amount of taxable income early in the life of an asset, which means that the associated income taxes are lower for the first few years. This means that a business initially has more cash available for other purposes. A second advantage is that it can accurately reflect the actual usage pattern of assets that tend to be more heavily utilized during their first few years of use, such as computers.

Disadvantages of the Declining Balance Method

The declining balance method is more difficult for the accountant to calculate. This means that it takes more accounting effort, and is also more prone to calculation errors. In addition, the result is unusually low asset carrying amounts, which can give the impression that a business is operating with a lower fixed asset investment than is really the case.

The Straight-Line Method

A more common depreciation method is the straight-line method, where the depreciation expense to be recognized is spread evenly over the useful life of the underlying asset. This method is the simplest to calculate, and generally represents the actual usage of assets over time. It is also more likely to leave carrying values on the balance sheet that reflect the remaining market values of assets (though there is not necessarily a direct relationship between carrying value and market value).

Terms Similar to the Declining Balance Method

The declining balance method is also known as the reducing balance method.