Available for sale securities definition

/What are Available for Sale Securities?

An available for sale security is a default classification used to classify securities that are not trading securities or held-to-maturity securities. All securities not falling into one of these other classifications is recorded as available for sale securities. Trading securities are any investments where the holder’s intent is to sell them in the short term for a profit. Held-to-maturity securities are any debt investments that are being held until their maturity date.

These classifications are mandated by Generally Accepted Accounting Principles for recording investments in the accounting records of a business. The classification is made when a security is purchased.

Accounting for Available for Sale Securities

If a business has investments in debt and equity securities that are classified as available-for-sale securities, and also if the equity securities have readily determinable fair values, then subsequently record their fair values in the balance sheet. Exclude any unrealized holding gains and losses from earnings, and instead report them in other comprehensive income until they have been realized (i.e., by selling the securities to a third party).

If an available-for-sale security is being hedged in a fair value hedge, then recognize the related holding gain or loss in earnings during the period of the hedge.

Available for sale securities may be classified as current assets on the balance sheet if they are to be liquidated within one year, or as long-term assets if they are to be held for a longer period of time.

Related AccountingTools Courses

Example of Available for Sale Securities

Plasma Storage Devices buys $10,000 of equity securities, which it classifies as available-for-sale. After one year, the quoted market price of the securities drops the total investment value to $8,000. In the following year, the quoted market price of the securities increases the total investment value to $11,000, and Plasma then sells the equity securities.

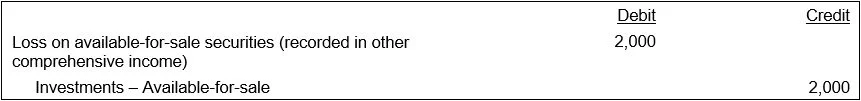

Plasma records the decline in value in the first year with the following entry:

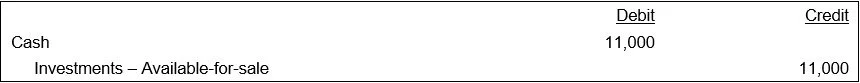

Plasma records the increase in value in the second year, as well as the sale of the investment, with the following entries: