Cash flow from financing activities

/What is Cash Flow from Financing Activities?

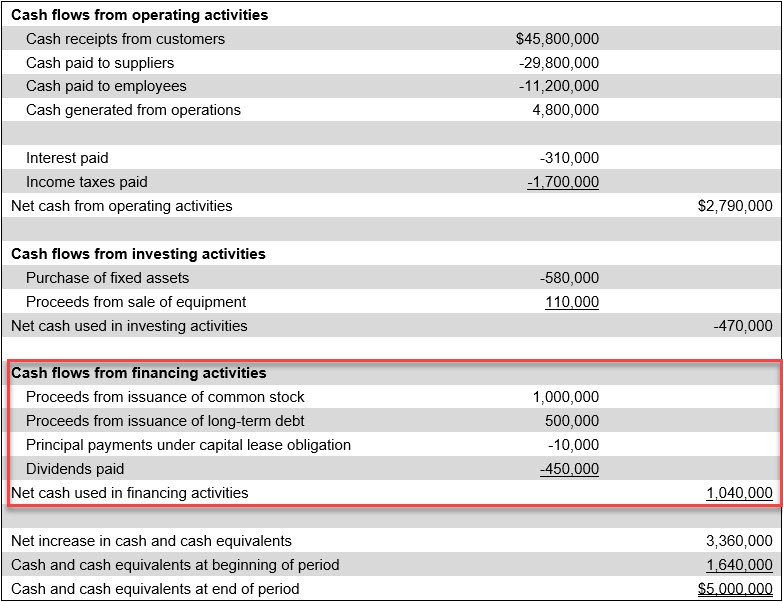

The cash flows from financing activities are those cash inflows and outflows resulting in alterations to the amount of a firm’s contributed equity and borrowings. These cash flows are generally associated with liabilities or equity, and involve transactions between the reporting entity and its providers of capital. The cash flows are reported on the statement of cash flows. This part of the statement is highlighted in the following exhibit.

By examining this section of the statement of cash flows, you can discern the actions being taken in regard to the capital structure of a business.

Examples of Cash Flow from Financing Activities

Examples of cash inflows form financing activities are cash receipts from the sale of an organization’s own equity instruments, or from issuing debt, and the proceeds from derivative instruments.

Examples of cash outflows from financing activities are cash outlays for dividends, share repurchases, payments for debt issuance costs, and the pay down of outstanding debt.

Related AccountingTools Courses

Other Types of Cash Flow

There are two other types of cash flows that are reported in the statement of cash flows. One is cash flows from operating activities. These are an entity’s primary revenue-producing activities. Operating activities is the default classification, so if a cash flow does not belong in either of the other classifications, it belongs here. Operating cash flows are generally associated with revenues and expenses. Examples of cash inflows from operating activities are cash receipts from the sale of goods or services, accounts receivable, lawsuit settlements, normal insurance settlements, and supplier refunds. Examples of cash outflows for operating activities are for payments to employees and suppliers, fees and fines, lawsuit settlements, cash payments to lenders for interest, contributions to charity, cash refunds to customers, and the settlement of asset retirement obligations.

The other type of cash flow is cash flows from investing activities. These are investments in productive assets, as well as in the debt and equity securities issued by other entities. These cash flows are generally associated with the purchase or sale of assets. Examples are cash receipts from the sale or collection of loans, the sale of securities issued by other entities, the sale of long-term assets, and the proceeds from insurance settlements related to damaged property. Examples of cash outflows from investing activities are cash payments for loans made to other entities, the purchase of the debt or equity of other entities, and the purchase of fixed assets (including capitalized interest).

How to Interpret Cash Flow from Financing Activities

Several issues can be discerned by perusing the contents of this part of the statement of cash flows. First, it the reporting entity is continually taking on more debt and/or equity, this is a sign that it may not be generating sufficient cash internally to support its ongoing operations. This can be confirmed by checking the income statement to see if the firm is reporting unusually low profit margins or losses.

Another warning sign is when the reporting entity is paying out large dividends or buying back shares when its reported profits are relatively low. This could indicate that management is choosing to support the stock price over the short term, rather than investing funds back into the business.

Related Articles

Statement of Cash Flows Overview

The Difference Between Cash Flow and Funds Flow

The Difference Between the Direct and Indirect Cash Flow Statements