Capital expenditure budget definition

/What is the Capital Expenditure Budget?

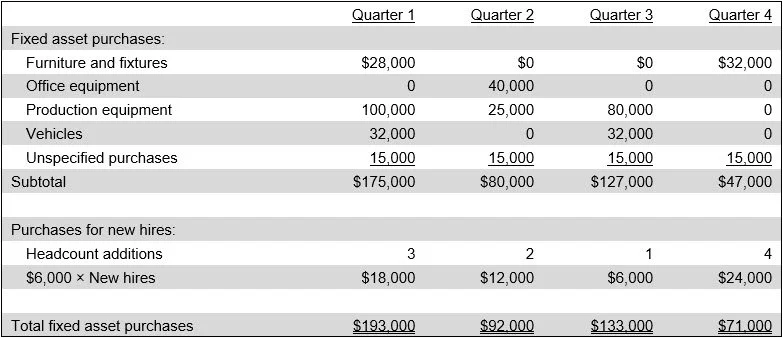

A capital expenditure budget is a formal plan that states the amounts and timing of fixed asset purchases by an organization. This budget is part of the annual budget used by a firm, which is intended to organize activities for the upcoming year. Capital expenditures can involve a wide array of expenditures, including upgrades to existing assets, the construction of new facilities, and equipment required for new hires. A sample capital expenditure budget appears in the following exhibit.

Related Courses

When to Construct a Capital Expenditure Budget

Constructing a capital expenditure budget makes sense when an organization anticipates significant capital outlays that require careful planning to align with strategic goals, manage cash flow, and ensure proper financing. Capital expenditure budgets are particularly valuable during periods of expansion, facility upgrades, or modernization efforts, where large investments must be prioritized and timed effectively. They are also essential in industries with high fixed costs or where assets require regular replacement. By forecasting future capital needs, an organization can avoid overextending its resources, while evaluating the return on investment for each proposed project in an orderly manner.

How to Construct a Capital Expenditure Budget

The capital expenditure budget is typically arrived at through an iterative process, where the management team evaluates the rate of return on each proposed project, as well as legal and regulatory requirements and the impact of a project on the bottleneck operation of the business. The amount of fixed assets acquired will also vary based on the activity level projected in the rest of the budget, which in turn will be adjusted to match the expansion capabilities of the organization and the amount of cash flows that will be needed to fund growth.

Duration of a Capital Expenditure Budget

A capital expenditure budget may span a longer period than the annual budget. The reason is that some larger fixed asset acquisitions involve lengthy construction periods that can greatly exceed one year. In addition, the nature of the business may involve an ongoing series of major construction projects that could extend for up to a decade into the future. For example, a chip fabrication company competes by constructing successively more complex facilities, each requiring up to five years to complete.