Activity cost assignment definition

/What is Activity Cost Assignment?

Activity cost assignment involves the use of activity drivers to assign costs to cost objects. The concept is used in activity-based costing to give more visibility to the total amount of costs that are incurred by cost objects. Cost assignment is essential to a better understanding of the true cost of cost objects. With proper activity cost assignments, managers are in a better position to make informed decisions about where to allocate funds, enhance systems, and set the prices of goods and services.

Example of Activity Cost Assignment

Branson Furniture produces two types of products, which are wooden tables and wooden chairs. The company uses a variety of resources in its production process, including materials, labor, and machine hours, and they’ve implemented activity-based costing to better understand the costs associated with each product. The following five-step approach shows how an activity cost assignment would work for the company.

Step 1: Identify Activities and Costs

The company identifies the following activities involved in the production process:

Material Handling - Cost: $30,000

Machine Setup - Cost: $20,000

Quality Inspection - Cost: $10,000

Total Activity Cost = $30,000 + $20,000 + $10,000 = $60,000

Step 2: Determine Cost Drivers for Each Activity

Branson assigns a cost driver for each activity, which are as follows:

Material Handling: Number of raw material orders

Machine Setup: Number of machine setups

Quality Inspection: Number of inspections

Step 3: Measure Activity Usage by Product

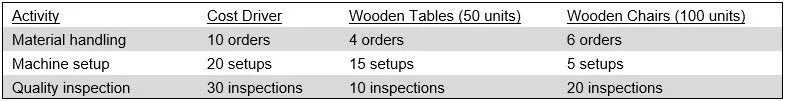

Branson calculates the usage of each activity for each product, as noted in the following exhibit:

Step 4: Calculate Activity Rates

The cost per unit of each activity (activity rate) is determined by dividing the total activity cost by the total number of cost drivers, as noted next:

Material Handling Rate = $30,000 ÷ 10 orders = $3,000 per order

Machine Setup Rate = $20,000 ÷ 20 setups = $1,000 per setup

Quality Inspection Rate = $10,000 ÷ 30 inspections = $333.33 per inspection

Step 5: Assign Costs to Products Based on Usage

Now, assign the costs to each product based on its consumption of activities.

For Wooden Tables:

Material Handling = 4 orders × $3,000/order = $12,000

Machine Setup = 15 setups × $1,000/setup = $15,000

Quality Inspection = 10 inspections × $333.33/inspection = $3,333.30

Total Cost for Wooden Tables = $12,000 + $15,000 + $3,333.30 = $30,333.30

For Wooden Chairs:

Material Handling = 6 orders × $3,000/order = $18,000

Machine Setup = 5 setups × $1,000/setup = $5,000

Quality Inspection = 20 inspections × $333.33/inspection = $6,666.60

Total Cost for Wooden Chairs = $18,000 + $5,000 + $6,666.60 = $29,666.60

Summary of Activity Costs Assigned

Wooden Tables: $30,333.30

Wooden Chairs: $29,666.60

In this example, the activity costs were assigned to each product based on their usage, providing a clearer view of the costs associated with each product than traditional costing methods.