Accounting for bonds

/What is a Bond?

A bond is a fixed obligation to pay that is issued by a corporation or government entity to investors. Bonds are used to raise cash for operational or infrastructure projects. Bonds usually include a periodic coupon payment, and are paid off as of a specific maturity date.

How to Account for a Bond

The accounting for bonds involves a number of transactions over the life of a bond. The accounting for these transactions from the perspective of the issuer is noted below.

Accounting for Bond Issuance

When a bond is issued at its face amount, the issuer receives cash from the buyers of the bonds (investors) and records a liability for the bonds issued. The liability is recorded because the issuer is now liable to pay back the bond. The journal entry is:

| Debit | Credit | |

| Cash | xxx | |

| Bonds payable | xxx |

If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a discount on bonds payable account. This happens when investors want a higher return on their investment. The entry would be:

| Debit | Credit | |

| Cash | xxx | |

| Discount on bonds payable | xxx | |

| Bonds payable | xxx |

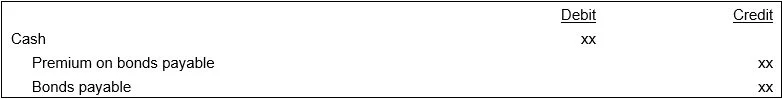

If investors buy the bonds at a premium, the difference between the face value of the bonds and the amount of cash received is recorded in a premium on bonds payable account. This happens when investors are willing to accept a lower return on their investment, because the stated interest rate is higher than the market interest rate. The entry would be:

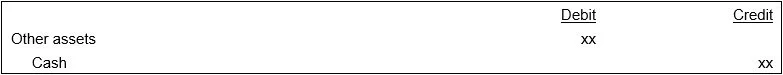

There may be a variety of bond issuance costs, such as commissions, legal expenses, printing costs, and registration fees. These costs are recorded in an asset account, and then charged to expense on a straight-line basis over the term of the bond. The initial entry would be:

Related AccountingTools Courses

Accounting for Bond Interest Payments

The recorded amount of interest expense is based on the interest rate stated on the face of the bond. Any further impact on interest rates is handled separately through the amortization of any discounts or premiums on bonds payable, as discussed below. The entry for interest payments is a debit to interest expense and a credit to cash.

Accounting for Bond Amortization

If a discount or premium was recorded when the bonds were issued, the amount must be amortized over the life of the bonds. If the amount is small, it can be calculated on a straight-line basis. If the amount is material, or if a greater degree of accuracy is desired, calculate the periodic amortization using the effective interest method.

If there was a discount on bonds payable, then the periodic entry is a debit to interest expense and a credit to discount on bonds payable; this has the effect of increasing the overall interest expense recorded by the issuer. If there was a premium on bonds payable, then the entry is a debit to premium on bonds payable and a credit to interest expense; this has the effect of reducing the overall interest expense recorded by the issuer.

The periodic amortization of bond issuance costs is recorded as a debit to financing expenses and a credit to the other assets account.

Accounting for Bond Redemption

When it is time to redeem the bonds, all premiums and discounts should have been amortized, so the entry is simply a debit to the bonds payable account and a credit to the cash account.

Related Articles

How to Account for Bond Issue Costs

How to Calculate the Carrying Value of a Bond