Why are sales a credit?

/Sales are credited because they represent an increase in a company’s revenues, which ultimately boosts the owner's equity. In double-entry bookkeeping, increases in equity accounts are recorded as credits, so when a business makes a sale, it credits the sales account to reflect this growth. At the same time, either cash or accounts receivable is debited, showing that the company has either received money or earned the right to receive money. This system keeps the accounting equation balanced, ensuring that every transaction affects at least two accounts properly.

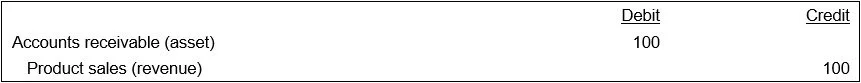

In essence, the debit increases one of the asset accounts, while the credit increases shareholders’ equity. These offsetting entries are explained by the accounting equation, where assets must equal liabilities plus equity. A sample journal entry that shows the credit entry for a $100 sale for which an invoice was issued appears in the following exhibit.

The sales account accumulates the detail for all sales transactions over the course of a company’s fiscal year, after which the account balance is flushed out with closing entries and transferred in aggregate into the retained earnings account (which is an equity account).

Accounting for a Sales Reversal or Reduction

There are cases in which a sale is reversed (perhaps due to a product return) or reduced (perhaps due to the application of a volume discount). When this happens, the sales account is debited, which reduces its balance. A follow-on effect of this entry is that the profits reported by the organization will decline.