Pro forma financial statements definition

/What are Pro Forma Financial Statements?

Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal. A budget may also be considered a variation on pro forma financial statements, since it presents the projected results of an organization during a future period, based on certain assumptions.

Examples of Pro Forma Financial Statements

Several examples of pro forma financial statements are noted below.

Full-Year Pro Forma Projection

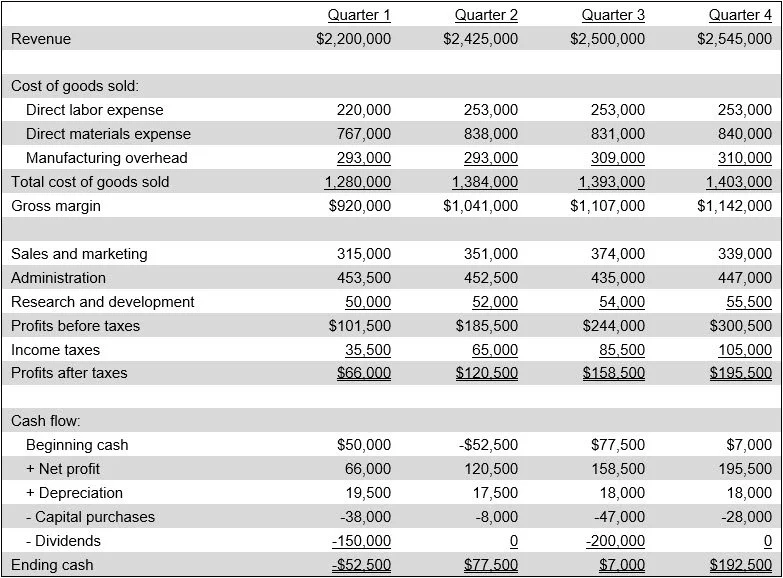

A full-year pro forma is a projection of a company's year-to-date results, to which are added expected results for the remainder of the year, to arrive at a set of full-year pro forma financial statements. This approach is useful for projecting expected results both internally to management, and externally to investors and creditors. An example of a full-year pro forma projection appears in the following exhibit, where results are itemized by quarter.

Related AccountingTools Courses

Investment Pro Forma Projection

A company may be seeking funding, and wants to show investors how the company's results will change if they invest a certain amount of money in the business. An investment pro forma projection may result in several different sets of pro forma financial statements, each designed for a different investment amount.

Historical with Acquisition

Historical pro forma financials provide a backward-looking projection of a company's results in one or more prior years that includes the results of another business that the company wants to purchase, net of acquisition costs and synergies. This approach is useful for seeing how a prospective acquisition could have altered the financial results of the acquiring entity. You can also use this method for a shorter look-back period, just to the beginning of the current fiscal year; doing so gives investors a view of how the company would have performed if a recent acquisition had been made as of the beginning of the year; this can be a useful extrapolation of the results that may occur in the next fiscal year.

Risk Analysis

It may be useful to create a different set of pro forma financial statements that reflect best-case and worst-case scenarios for a business, so that managers can see the financial impact of different decisions and the extent to which they can mitigate those risks.

Adjustments to GAAP or IFRS

Management may believe that the financial results it has reported under either the GAAP or IFRS accounting frameworks are inaccurate, or do not reveal a complete picture of the results of their business (usually because of the enforced reporting of a one-time event). If so, they may issue pro forma financial statements that include the corrections they believe are necessary to provide a better view of the business. The Securities and Exchange Commission takes a dim view of this kind of adjusted reporting, and has issued regulations about it in their Regulation G.

How to Create Pro Forma Statements

The key steps required to create pro forma financial statements are noted below:

Project revenues. Start by estimating future sales based on historical data, market trends, and anticipated changes in operations or pricing. This projection sets the foundation for the rest of the financial statements. It’s important to consider seasonal variations, economic conditions, and sales growth strategies. Accurate revenue forecasting ensures more reliable projections for expenses and profits.

Estimate expenses. Once revenues are projected, estimate the costs associated with generating those revenues, including cost of goods sold and operating expenses. Use historical percentages and trends to forecast these costs, adjusting for anticipated changes like new hires, inflation, or cost-saving measures. Separating fixed and variable expenses helps improve accuracy. These estimates will determine the company’s gross and operating margins.

Prepare the income statement. Using the projected revenues and expenses, prepare the pro forma income statement. This shows expected profitability over the forecast period, including gross profit, operating income, and net income. It helps stakeholders evaluate the company's future earnings potential. Non-operating items like taxes and interest should also be considered in this step.

Develop the balance sheet. Next, project assets, liabilities, and equity based on the income statement and anticipated changes in operations. For example, increased sales may require more inventory or accounts receivable. Financing activities, such as new loans or equity investments, also impact the balance sheet. Ensure that the balance sheet remains balanced, with assets equaling liabilities plus equity.

Create the cash flow statement. The cash flow statement is derived from the income statement and balance sheet projections. It shows how much cash the business expects to generate and use in operating, investing, and financing activities. This step is crucial for understanding liquidity and ensuring the business can meet its short-term obligations. It also helps identify potential cash shortfalls in advance.

Review the pro forma statements. Review all pro forma statements for consistency and accuracy. Compare projections to historical data and industry benchmarks to ensure they’re realistic. This step may involve revising assumptions or scenarios to improve reliability. A thorough analysis helps decision-makers plan strategically and prepare for various financial outcomes.

Problems with Pro Forma Financial Statements

There can be a significant problem with issuing pro forma financial statements to the public, since they contain management's assumptions about business conditions that may vary substantially from actual events, and which may, in retrospect, prove to be extremely inaccurate. Generally, pro forma financial statements tend to portray a business as being more successful than it really is, and having more financial resources available than may actually be the case. Consequently, investors should be extremely cautious when evaluating these types of financial statements, and spend time understanding how they differ from the issuing firm's normal financial statements.