Balance sheet definition

/What is a Balance Sheet?

The balance sheet is a report that summarizes all of an entity's assets, liabilities, and equity as of a given point in time. It is typically used by lenders, investors, and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an entity's financial statements. Of the financial statements, the balance sheet is stated as of the end of the reporting period, while the income statement and statement of cash flows cover the entire reporting period.

Related AccountingTools Courses

The Interpretation of Financial Statements

Components of a Balance Sheet

The line items that appear in a balance sheet will vary somewhat by business as well as by industry. Usually, the line items used for the balance sheets of companies located in the same industry will be similar, since they all deal with the same types of transactions. The line items are presented in their order of liquidity, which means that the assets most easily convertible into cash are listed first, and those liabilities due for settlement soonest are listed first. Generally, the following line items will be found in most balance sheets:

Assets

Assets are usually segregated into current assets and long-term assets, where current assets include anything expected to be liquidated within one year of the balance sheet date. This usually means that all assets except fixed assets are classified as current assets. The most common asset accounts are noted below, sorted by their order of liquidity.

Cash and cash equivalents. This line item includes all checking and savings accounts, as well as coins and bills kept on hand, certificates of deposit, and Treasury bills.

Marketable securities. This line item includes all investments in debt and equity securities that can be readily sold off through a liquid market (such as a stock exchange).

Prepaid expenses. This line item includes any supplier invoices that have already been paid but for which the related service has not yet been consumed (such as rent or advertising).

Accounts receivable. This line item includes amounts billed to customers that have not yet been paid, as well as an offsetting allowance for doubtful accounts. It also includes non-trade receivables, such as amounts owed to the company by its employees.

Inventory. This line item includes all raw materials, work-in-process, and finished goods owned by the business. It also includes any inventory held on consignment at other organizations. It may be offset by an allowance for obsolete inventory.

Fixed assets. This line item includes all fixed assets that have been capitalized by the business, such as land, buildings, equipment, vehicles, software, and leasehold improvements. There is an offset to the account for accumulated depreciation.

Liabilities

Liabilities are usually segregated into current liabilities and long-term liabilities, where current liabilities include anything expected to be settled within one year of the balance sheet date. This usually means that all liabilities except long-term debt are classified as current liabilities. The most common liability accounts are noted below, sorted by their order of liquidity.

Accounts payable. This line item includes all goods and services billed to the company by its suppliers.

Accrued liabilities. This line item includes all goods and services delivered or provided to the company, for which suppliers have not yet sent the company an invoice. This amount tends to be much lower than the balance in the accounts payable line item.

Customer prepayments. This line item contains any payments made to the company for goods or services that the company has not yet fulfilled. Any amounts in this line item are gradually shifted over to revenue as the company’s obligations are fulfilled.

Taxes payable. This line item contains all taxes for which the company has an obligation to pay the applicable government that have not yet been paid. Examples of the taxes that may be included in this line item are property taxes, sales taxes, use taxes, withheld employee income taxes, and income taxes to be paid by the company.

Short-term debt. This line item contains all debt owed by the company that must be paid within the next year.

Long-term debt. This line item contains all debt owed by the company that must be paid in more than one year.

Shareholders’ Equity

The shareholders’ equity section includes the amounts paid into the firm by shareholders in exchange for shares in the business, as well as any profits retained in the business. It also subtracts out any amounts paid to buy shares back from shareholders. The most common shareholders’ equity accounts are noted below.

Stock. This line item includes the par value of all shares sold by the business to investors and not repurchased by the business. This line item may be split into common stock and preferred stock.

Additional paid-in capital. This line item includes the excess amount that investors have paid over the par value of shares. This amount tends to be substantially higher than the total in the stock line item.

Retained earnings. This line item contains the net amount of all profits and losses generated by the business since its inception, minus any dividends paid to shareholders.

Treasury stock. This line item contains the amount paid by the business to acquire shares back from investors.

Example of a Balance Sheet

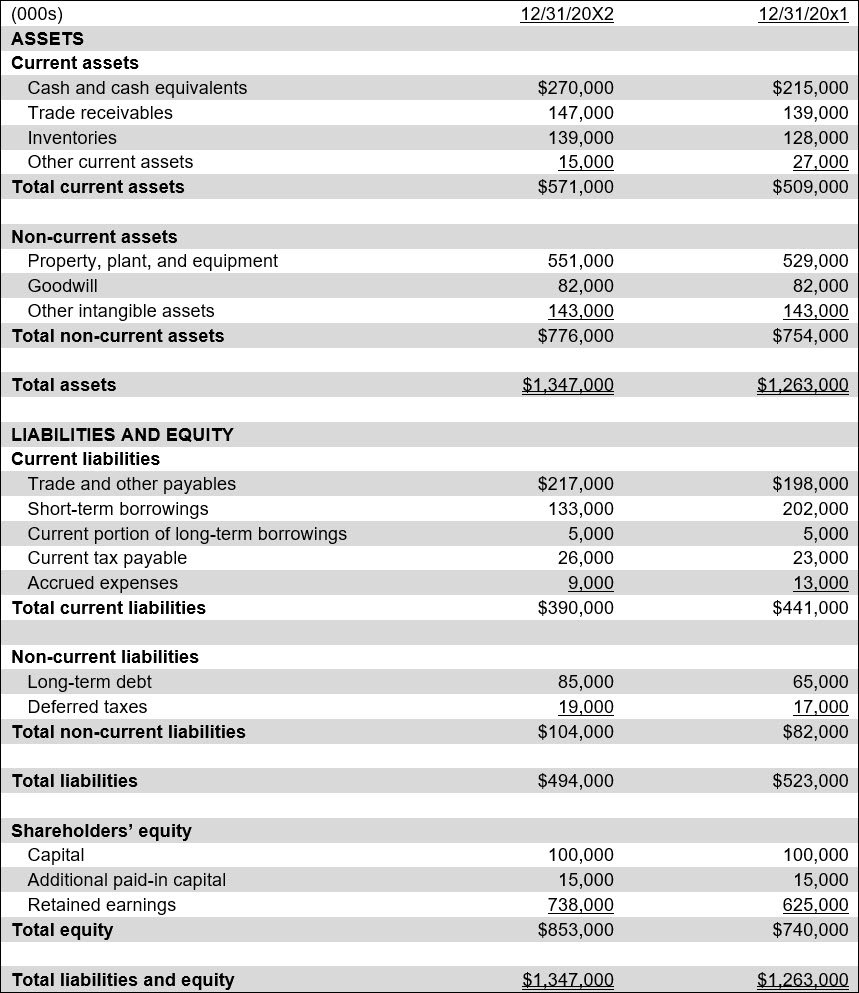

A sample balance sheet appears next, in a format that includes results as of the end of the current reporting period and as of the end of the same reporting period for the prior year. This two-period approach is useful for spotting differences in account balances over time. To maximize the usefulness of this approach, the same transaction types should be consistently recorded in the same accounts over the measurement period, so that they appear in the same line items on the balance sheet.

The Accounting Equation

The total amount of assets listed on the balance sheet should always equal the total of all liabilities and equity accounts listed on the balance sheet (also known as the accounting equation), for which the equation is:

Assets = Liabilities + Equity

If this is not the case, a balance sheet is considered to be unbalanced, and should not be issued until the underlying accounting recordation error causing the imbalance has been located and corrected.

As an example of how the accounting equation works, a store owner wants to buy new shelves, at a cost of $1,000. To do so, he purchases the shelves on credit for $1,000 from an office supply store. This results in a $1,000 increase in the store owner’s assets (the shelves), as well as an offsetting $1,000 in liabilities (accounts payable). This represents a balanced transaction, where assets increased by $1,000 and liabilities also increased by $1,000. Later, the store owner must pay the office supply store’s bill, which he does by reducing assets by $1,000 (since cash balance declines), and paying off the bill (reducing liabilities by $1,000). The transaction is balanced once again, as both assets and liabilities decline by the same amount.

Importance of the Balance Sheet

The balance sheet is generally considered to be the second most important of the financial statements (after the income statement), because it states the financial position of the reporting entity as of the balance sheet date. When viewed in conjunction with the other financial statements, it generates a clear picture of the financial situation of a business. In particular, the balance sheet can be used to examine four types of metrics, which are noted below. When comparing these metrics to the results of other businesses for benchmarking purposes, it is important to restrict the analysis to other businesses within the same industry, since the financial structures of businesses vary considerably across industries.

Efficiency Metrics

The asset information on the balance sheet can be combined with the sales line item on the income statement to estimate the efficiency with which a business is using its assets to produce sales. For example, the asset turnover ratio shows the efficiency of asset usage by dividing average total assets by net sales. Similarly, net working capital can be compared to sales to estimate the efficiency of working capital usage.

Leverage Metrics

It is essential for any lender or creditor to understand the leverage of a borrower, to estimate its ability to pay back debt. This is most commonly done by comparing the debt and equity totals on the balance sheet to derive a debt to equity ratio.

Liquidity Metrics

A business must be able to pay its obligations when due. This is done by calculating the current ratio, which compares current assets to current liabilities. Ideally, current assets should be substantially higher than current liabilities, indicating that the assets can be liquidated to pay off the liabilities. A variation is the quick ratio, which strips the inventory asset out of the current ratio calculation, on the grounds that inventory can be difficult to convert into cash in the short term.

Rates of Return

The return generated by a business can be calculated by dividing the net income figure on the income statement by the shareholders’ equity figure on the balance sheet. A variation on the concept is to divide net income by the total assets figure on the balance sheet. Either approach is used by investors to determine the rate of return being generated.

Limitations of the Balance Sheet

There are several balance sheet limitations to be aware of, which are as follows:

Historical cost basis. Some of the information presented in this report is stated at its historical cost (such as fixed assets), while other information is presented at its current cost (such as marketable securities). Thus, it presents of mix of cost types.

Subject to manipulation. Some information in the report is subject to manipulation. For example, the amount of accounts receivable will depend on the offsetting balance in the allowance for doubtful accounts, which contains a guesstimated balance. Also, accelerated depreciation can be used to artificially reduce the reported amount of fixed assets, so that the fixed asset investment appears to be lower than is really the case.

Snapshot nature. The information in the report is presented as of a specific point in time, rather than for a reporting period, and so may not be representative of the average account balances over an extended period of time.

Subjectivity in valuations. The valuation of some assets and liabilities, like accounts receivable (subject to bad debt allowances) or contingent liabilities, often involves estimates and judgment, which can introduce subjectivity and inaccuracies.

Omits some intangible assets. Certain intangible assets, such as brand value, employee expertise, or internally developed goodwill, are not always recorded, leading to an incomplete representation of the company's true value.

Dependence on accounting policies. Different accounting standards (e.g., IFRS vs. GAAP) and policies can lead to variations in how items are reported, impacting comparability between companies.

While the balance sheet is a crucial tool for assessing a company’s financial health, it should be analyzed in conjunction with other financial statements and non-financial information for a comprehensive understanding.

Who Prepares the Balance Sheet?

The balance sheet is prepared from an organization’s general ledger, and is automatically generated by its accounting software. It is reviewed and adjusted by the firm’s general ledger accountant. In a smaller firm, this task is taken on by the bookkeeper, with the completed balance sheet being reviewed by an outside accountant. If a company is publicly-held, then the contents of its balance sheet is reviewed by outside auditors for the first, second, and third quarters of its fiscal year. The auditors must conduct a full audit of the balance sheet at year-end, before the year-end balance sheet can be released.

Terms Similar to the Balance Sheet

The balance sheet is also known as the statement of financial position.

Related Articles

Does an Expense Appear on the Balance Sheet?

How the Balance Sheet and Income Statement are Connected

Should There Be Negative Cash on the Balance Sheet?

The Difference Between a Trial Balance and Balance Sheet