Payroll register definition

/What is a Payroll Register?

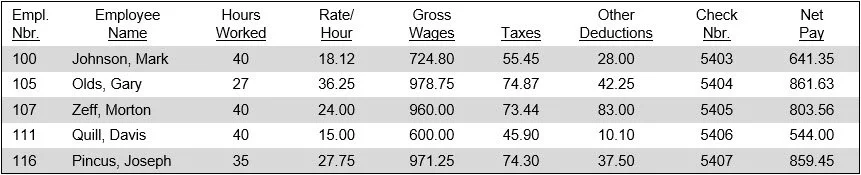

A payroll register is a comprehensive report that details all payments made to employees during a specific pay period. It includes essential information such as employee names, identification numbers, hours worked, gross wages, deductions, taxes withheld, and net pay. The report also outlines various deductions, including federal and state taxes, Social Security, Medicare, retirement contributions, and other benefits. Employers use the payroll register to ensure accuracy in payroll processing, maintain compliance with tax regulations, and provide a clear record for financial reporting. This document is a vital tool for managing payroll expenses and preparing tax filings.

Contents of a Payroll Register

The information stated in a payroll register for each employee includes the person’s name, employee number, social security number, gross pay, net pay, payroll deductions, tax withholdings, regular hours worked, overtime hours worked, and other types of hours worked. The report also includes the grand totals for gross pay, deductions, and net pay. A sample payroll register appears in the following exhibit.

Related AccountingTools Courses

Optimal Accounting for Payroll

How to Use a Payroll Register

The bookkeeper who is running the periodic payroll uses preliminary versions of the payroll register to ensure that payments have been processed correctly. If there are errors, then the payroll is run again and the register is examined for additional errors. As a control, a manager usually has to review and formally approve the final payroll register before payments are issued to employees. This signed copy of the register is then retained as proof that the control is being followed. In addition, the totals on this register can be used as the basis for a payroll journal entry.