Intercompany eliminations definition

/What are Intercompany Eliminations?

Intercompany eliminations are used to remove from the financial statements of a group of companies any transactions involving dealings between the companies in the group. There are three types of intercompany eliminations, which are noted below:

Intercompany debt. For intercompany debt, a business eliminates any loans made from one entity to another within the group, since these only result in offsetting notes payable and notes receivable, as well as offsetting interest expense and interest income. These issues most commonly arise when funds are being moved between entities by a centralized treasury department.

Intercompany revenue and expenses. For intercompany revenue and expenses, a business eliminates the sale of goods or services from one entity to another within the group. This means that the related revenues, cost of goods sold, and profits are all eliminated. The reason for these eliminations is that a company cannot recognize revenue from sales to itself; all sales must be to external entities. These issues most commonly arise when a company is vertically integrated.

Intercompany stock ownership. The intercompany stock ownership, a business eliminates the ownership interest of the parent company in its subsidiaries.

Related AccountingTools Courses

Example of Intercompany Eliminations

Universal Tire manufactures tires, and is affiliated with Acme Sales, which sells the tires to car manufacturers. Universal Tire sells its entire output to Acme at a 20% gross profit on its sale price. During Year 1, Universal Tire sells tires that cost $10,000,000 to Acme for $12,000,000. During that year, Acme sold all tires produced for $15,000,000 to outside parties.

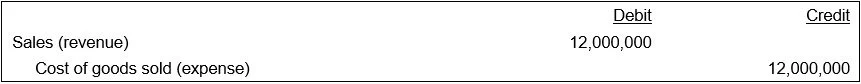

In the absence of intercompany eliminations, a consolidated income statement for the affiliated firms would include the $12 million of sales from Universal Tire to Acme Sales, as well as the $15,000,000 of Acme sales to outside parties, for an aggregate sale total of $27 million. This is a gross overstatement of sales, so the $12 million of sales from Universal Tire to Acme need to be eliminated before producing consolidated financial statements. This elimination entry is as follows:

The net effect of this adjusting entry is to remove not only the intercompany sales, but also the cost of goods sold recorded by Acme sales. By doing so, the consolidated financial statements show only the sales made to third parties and the cost of goods sold of Universal Tire. This means that the consolidated financial statements show $15 million of sales and a $10 million cost of goods sold.

Intercompany Transaction Controls

Intercompany transactions can be difficult to identify, and so require a system of controls to ensure that each of these items is properly identified and brought to the attention of the corporate accounting staff. The issue is of particular concern when an acquisition has just been completed, since the reporting controls are not yet in place at the new acquiree. If an enterprise resource planning (ERP) system is in place throughout the company, these transactions can typically be identified by flagging a transaction as it is created as being an intercompany item.

When an intercompany transaction has been identified in one period, it is entirely possible that the same type of transaction will occur again in the future. Accordingly, a reasonable control is for the corporate accounting staff to make a list of all intercompany transactions that have been identified in the past, and see if they have been dealt with again in the current period. If not, there may be an unflagged transaction that needs to be eliminated.

Given the difficulty of intercompany reporting, it is especially important to fully document the associated controls and resulting journal entries, since they are likely to be reviewed in detail by the company's auditors.