Closing entries | Closing procedure

/What are Closing Entries?

Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period.

The basic sequence of closing entries is as follows:

Debit all revenue accounts and credit the income summary account, thereby clearing out the balances in the revenue accounts.

Credit all expense accounts and debit the income summary account, thereby clearing out the balances in all expense accounts.

Close the income summary account to the retained earnings account. If there was a profit in the period, then this entry is a debit to the income summary account and a credit to the retained earnings account. If there was a loss in the period, then this entry is a credit to the income summary account and a debit to the retained earnings account.

The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders' equity section of the balance sheet.

Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely.

Related AccountingTools Courses

Example of Closing Entries

ABC International is closing its books for the most recent reporting period. ABC had $50,000 of revenues and $45,000 of expenses during the period. For simplicity, we will assume that all of the expenses were recorded in a single account; in a normal environment, there might be dozens of expense accounts to clear out. The sequence of entries is:

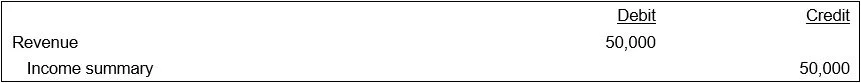

1. Empty the revenue account by debiting it for $50,000, and transfer the balance to the income summary account with a credit. The entry is:

2. Empty the expense account by crediting it for $45,000, and transfer the balance to the income summary account with a debit. The entry is:

| Debit | Credit | |

| Income summary | 45,000 | |

| Expenses | 45,000 |

3. Empty the income summary account by debiting it for $5,000, and transfer the balance to the retained earnings account with a credit. The entry is:

| Debit | Credit | |

| Income summary | 5,000 | |

| Retained earnings |

5,000 |

All of these entries have emptied the revenue, expense, and income summary accounts, and shifted the net profit for the period to the retained earnings account.

What is the Closing Procedure in Accounting?

Having just described the basic closing entries, we must also point out that a practicing accountant rarely uses any of them, since these steps are handled automatically by any accounting software that a company uses. Instead, the basic closing step is to access an option in the software to close the reporting period. Doing so automatically populates the retained earnings account for you, and prevents any further transactions from being recorded in the system for the period that has been closed.

Instead of the preceding entries, the practicing accountant is more concerned with completing a series of closing activities to ensure that all material transactions have been included in the accounting period. These closing activities include the following:

Complete all customer invoicing. To issue invoices, you will need to obtain shipping documentation from the warehouse, and verify that all of the paperwork has been forwarded.

Accrue any revenue that cannot be billed. There may be cases in which a customer agreement does not allow you to issue a formal billing; if so, you will need to accrue this revenue, and reverse it in the following reporting period.

Ensure that all supplier invoices have been entered. To do this, you may need to wait a few days for all supplier invoices to arrive.

Accrue any expenses for which no supplier invoices were received. If there are records of received goods or services for which no supplier invoices have been received, you will need to accrue the related expense, and reverse it in the next reporting period.

Update the allowance for doubtful accounts. If you are selling on credit, then some billed amounts will not be paid. You will need to update your bad debt reserve to account for these expected non-payments.

Accrue wages. If employees have not been paid through the end of the reporting period, accrue an expense for the missing amount.

Update the vacation accrual. Alter the vacation expense accrual, based on how many vacation hours were earned during the period and how many hours were taken.

Calculate commissions owed to the sales staff. Based on billed invoices to customers, calculate the commissions payable to the sales staff.

Complete the bank reconciliation. It is possible to do this on a daily basis, so that only a small part of the reconciliation still has to be completed at the end of the reporting period.

Calculate depreciation. Once all new fixed assets have been recorded, calculate the associated amount of depreciation expense.

Verify the physical inventory count. Review the period-end physical inventory count to see if it is reasonable. If not, conduct counts on any items that appear to be incorrect.

Value ending inventory. Using your inventory layering methodology, determine the value of the ending inventory.

Verify the contents of all cost pools to be allocated.

Apply overhead to inventory and the cost of goods sold.

Calculate income taxes.

Verify the contents of all asset and liability accounts. This may be a spot-check of just the larger-balance accounts for month-end closes, while a more detailed review is conducted at year-end.

Complete the financial statements and review for errors. There are nearly always errors in the first version of the financial statements, so review them in detail and investigate any problem areas found.

Correct any errors found.

Release the financial statements.

The number of closing activities may be quite substantially longer than the list shown here, depending upon the complexity of a company's operations and the number of subsidiaries whose results must be consolidated.

In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. In addition, if the company uses several sets of books for its subsidiaries, the results of each subsidiary must first be transferred to the books of the parent company and all intercompany transactions eliminated. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company.

Finally, if the parent company is engaged in any cash sweeping activities, it may be necessary to record loans from the contributing subsidiaries to the parent company for the amount of cash swept into the investment account of the parent company, with the parent paying interest to the subsidiaries for any loaned cash.

Related Articles

Accounts That Are Close at Year End

The Difference Between Adjusting Entries and Closing Entries