Liability definition

/What is a Liability?

A liability is a legally binding obligation payable to another entity. Liabilities are incurred in order to fund the ongoing activities of a business. Examples of liabilities are accounts payable, accrued expenses, wages payable, and taxes payable. These obligations are eventually settled through the transfer of cash or other assets to the other party. They may also be written off through bankruptcy proceedings.

Accounting for Liabilities

Recording a liability requires a debit to an asset or expense account (depending on the nature of the transaction), and a credit to the applicable liability account. When a liability is eventually settled, debit the liability account and credit the cash account from which the payment came.

Presentation of Liabilities

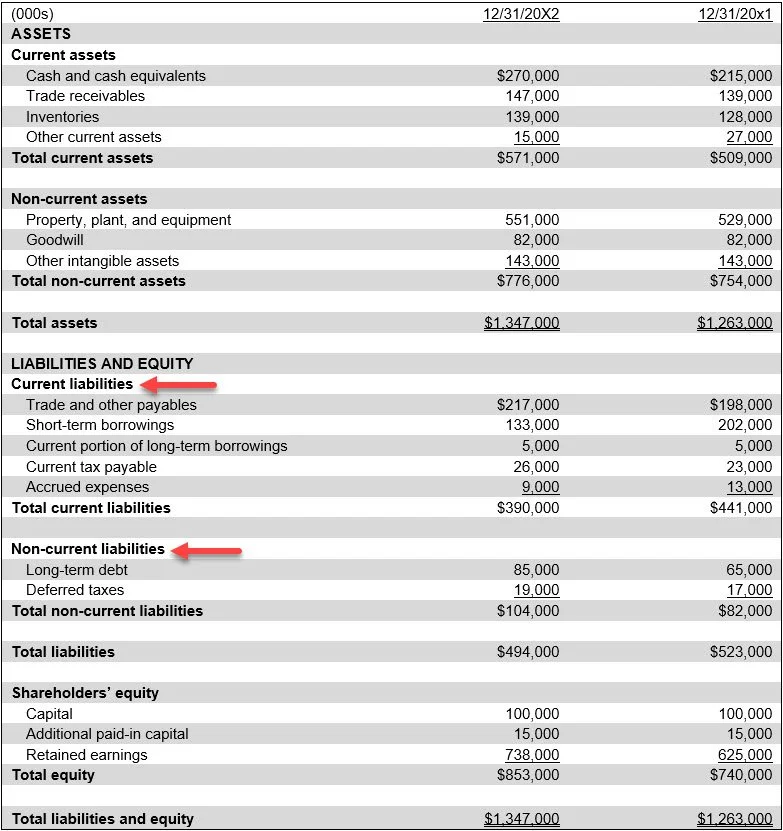

Liabilities expected to be settled within one year are classified as current liabilities on the balance sheet. All other liabilities are classified as long-term liabilities or non-current liabilities on the balance sheet. These two classifications appear in the following example balance sheet.