Invoice definition

/What is an Invoice?

An invoice is a document submitted to a customer, identifying a transaction for which the customer owes payment to the issuer. It provides documentation and a reminder to the customer that it owes the seller the amount stated on the invoice. It may be issued on paper or in an electronic format.

The Contents of an Invoice

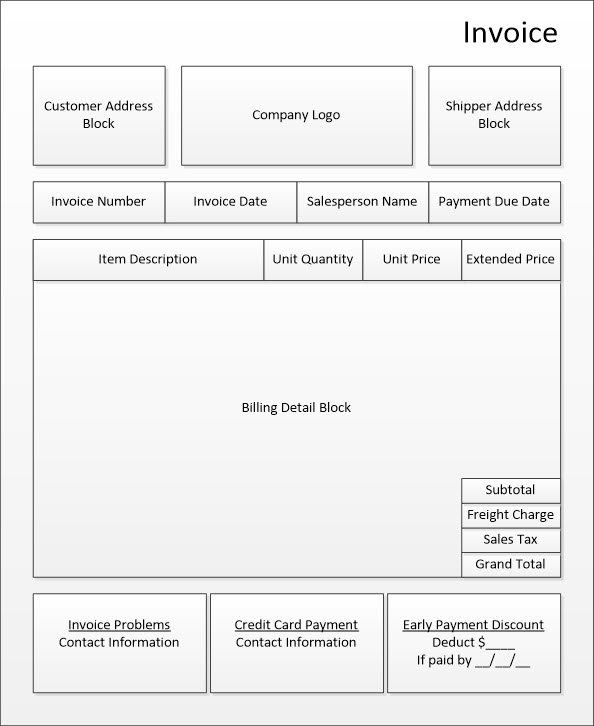

An invoice typically identifies the following information:

The invoice number

The name and address of the seller

The name and address of the buyer

The date of shipment or when services were delivered

A description of the items purchased

The quantities and total costs of the items purchased

Any sales taxes owed

Any shipping and handling charges

The grand total owed

Payment terms

The format of a typical invoice appears next.

Who Uses an Invoice?

An invoice is used by the buyer as the triggering document to initiate a payment transaction to the seller. It is typically compared to the buyer’s authorizing purchase order and receiving documentation (known as three-way matching) before a payment will be issued. Another user is the seller, which uses the invoice as a source document to prove that sales transactions have been created. The total of all invoices issued, less any credit memos, will sum to the credit sales total for the seller’s reporting period.

An invoice is an important source document for a company’s auditors. An auditor will likely want to review a sampling of all invoices issued as part of the procedures associated with an audit. The auditor will also send requests for confirmation to a seller’s customers, asking them to confirm the amounts stated on the invoices.

Invoice Best Practices

There are several best practices associated with invoicing. Here are several of them:

Structural enhancement. The structure of an invoice can have a major impact on the ability of a business to collect from its customers. For example, the exact date on which payment is due should be clearly stated, rather than simply stating (for example) 30 days from the current date. Also, any extraneous data that can confuse customers (such as internal company codes) should be removed from the invoice. Finally, put contact information inside a box, where customers can easily spot it.

Method of delivery. If you are currently mailing invoices to customers, consider switching to an electronic delivery method. Doing so not only eliminates the cost of mailing a printed invoice, it also eliminates the days during which the invoice would otherwise be transiting the postal system. This can result in more rapid payments by some customers.

Types of Invoices

Invoices have traditionally been issued as paper documents, but are increasingly issued in an electronic format, which can be sent as an email. Some invoices come with a “pay now” option, allowing customers to use a variety of payment types to make an immediate payment. The “pay now” option can greatly reduce the collection time experienced by a seller.

The Pro Forma Invoice

A pro forma invoice is a preliminary version of an invoice. It is sent to a customer prior to the delivery of goods or services. It describes what the seller will provide, the price that will be charged, and several related items. This document can be used to ensure customer agreement with the amount that will eventually be billed through a regular invoice. It is also used for documentation purposes when shipping goods across international borders.